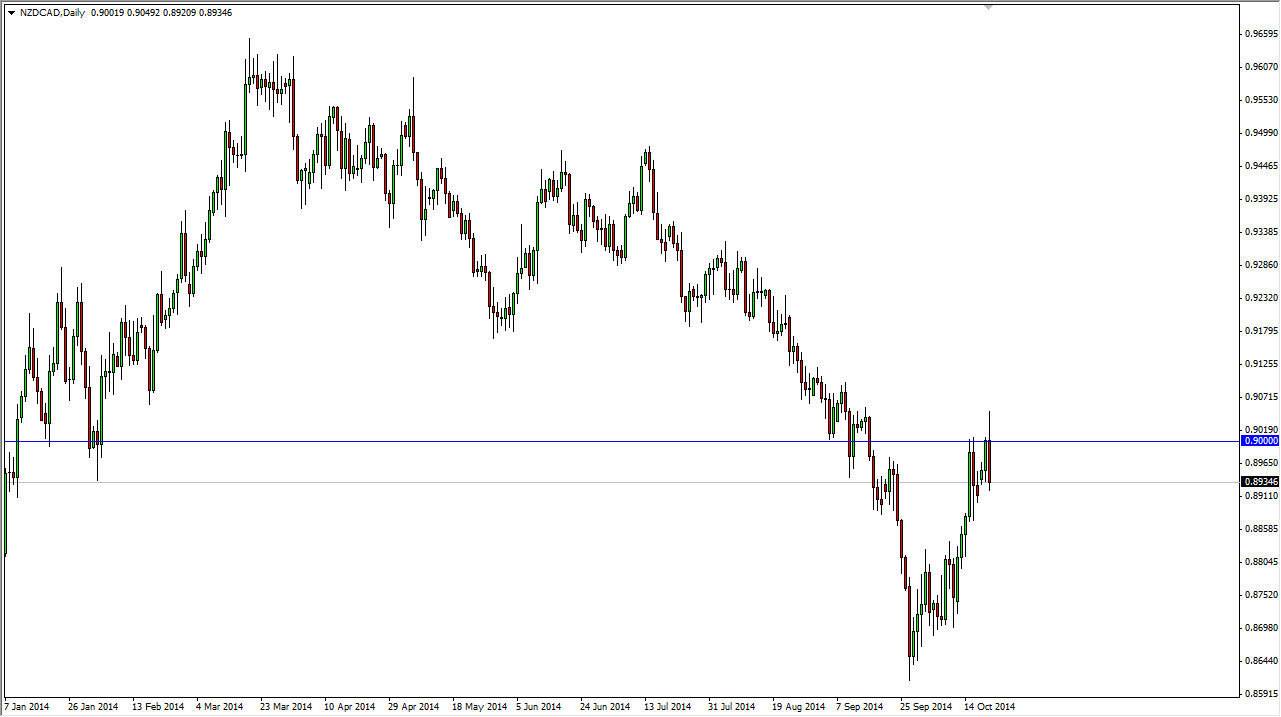

The NZD/CAD pair initially broke above the 0.90 handle during the session on Tuesday, but not significantly enough to keep those gains and it ended up turning around in forming a fairly bearish candle. On top of that, the NZD/USD pair did the same thing at the 0.80 handle, and formed a very negative candle in and of itself. With this, I think that the New Zealand dollar will continue to sell off in general, as this is basically a comparison between “Asia and North America.” Right now, the North Americans are certainly in the driver seat as far as economic development is concerned, as well as growth. The Asian economies are hurting a bit, so it’s not a big surprise to see a currency that is somewhat of a proxy for Asian growth get beat down.

Let us not forget the central bank

The Royal Bank of New Zealand has been selling the Kiwi dollar against the US dollar recently, and wants to see the market depreciate for the Kiwi dollar itself. It has a target of 0.68 as “fair value” against the US dollar, so the New Zealand dollar should continue to weaken given enough time anyway. Because of this, it should carry over into this marketplace, and I believe that a break down below the bottom of the range for the session on Tuesday probably sends this market looking for the 0.88 level first, and then ultimately the 0.8650 handle next.

I also believe that we go much lower than that, but it will of course be a bit of a fight to get below the most recent low has there will obviously be some bit of support down there. I think rallies will continue to offer selling opportunities, and even though the oil markets are not presently helping the value the Canadian dollar, I feel that this market is more or less a reflection on the New Zealand dollar and the New Zealand economy versus North America, and therefore should continue to drift lower.