Gold prices continued to sink yesterday, extending losses from Wednesday's session, and touched the lowest level in nearly 4 weeks on technical selling and upbeat U.S. economic data. The Commerce Department's report showed that gross domestic product grew at a 3.5% annual rate in the third quarter, above expectations of a 3.1% rise. Yesterday's data is consistent with the FOMC's decision to end the asset-buying program. The Federal Reserve's confidence in the economy corroborates the idea that the U.S. will remain strong in the face of global stagnation.

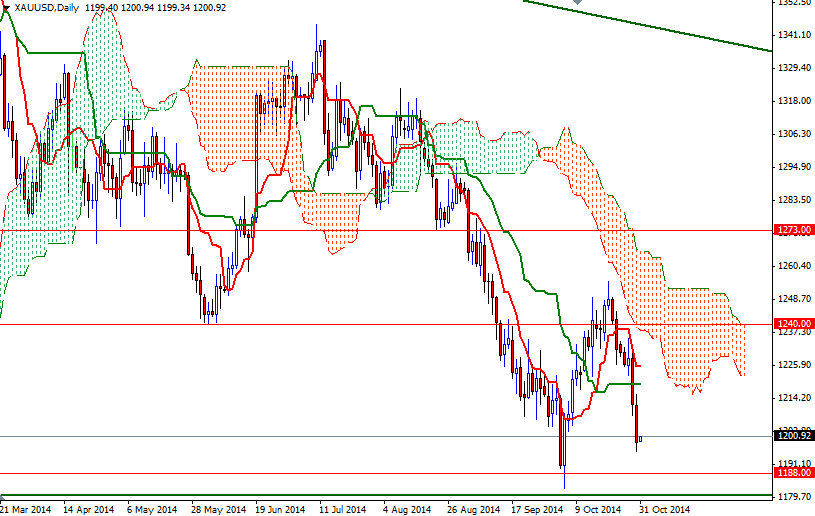

Although recent reports shows some central banks -particularly in the emerging economies- are increasing the proportion of gold in their reserve assets, these purchases couldn't reverse the mid-term trend. Looking at the long term charts from a purely technical point of view, I see the bulls are getting weaker compared to the previous bounces.

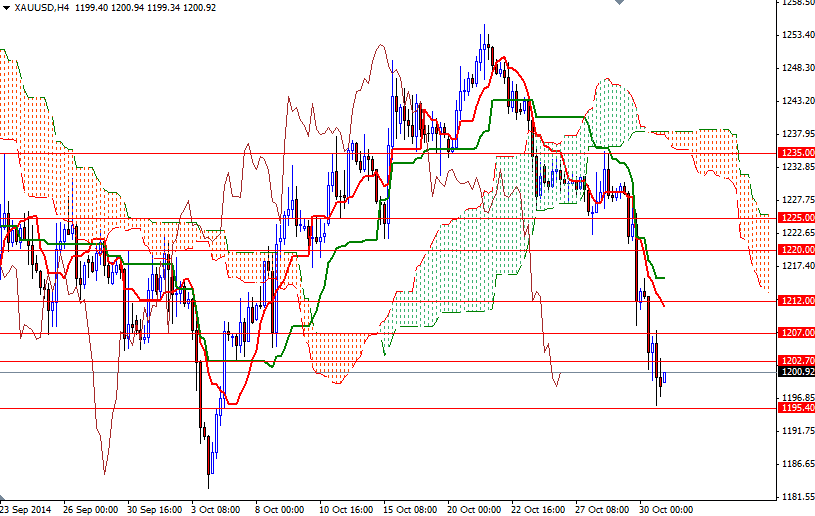

On the weekly, daily and 4-hour time frames, the XAU/USD pair is trading below the Ichimoku clouds and that paints a bearish picture. Once again we are approaching the critical 1180/3 support area which will put significant amount of pressure on the market if broken. However, today is the last trading day of the week and October so we may get stuck in a relatively narrow trading range. I think that 1202.70 and 1195.40 will be the key levels to watch. If the bears continue to dominate prices and pull the XAU/USD pair below 1195.40, their next target will be the 1188 support level. In order to ease selling pressure, the market has to break through the 1202.70 level. Only a daily close above 1207 could give the bulls a chance to march towards 1212.