After four consecutive days of losses it appears that the XAU/USD pair (Gold vs. the American dollar) steadied during the Asian session today. In the latest economic data, Markit's flash manufacturing purchasing managers’ index came in at 57.3, down from the previous month's upwardly revised 58.9 and below expectations for a reading of 57.9. A separate report released by the National Association of Realtors showed that the index of pending home sales increased 0.3% in September.

Looking forward, market participants will turn their focus to the Federal Reserve's two-day policy meeting which starts today. At its September meeting the central bank indicated that it planned to end the quantitative easing program this month. However, Fed officials also emphasized that raising interest rates prematurely was a greater risk than lifting them too late.

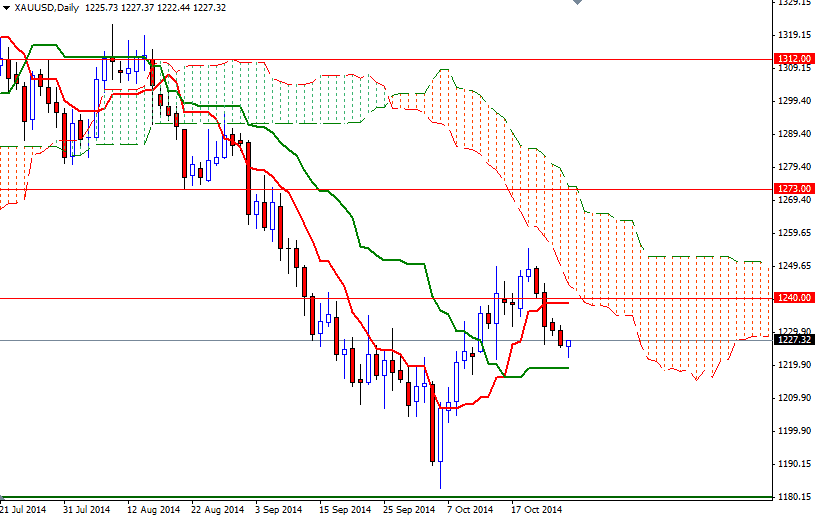

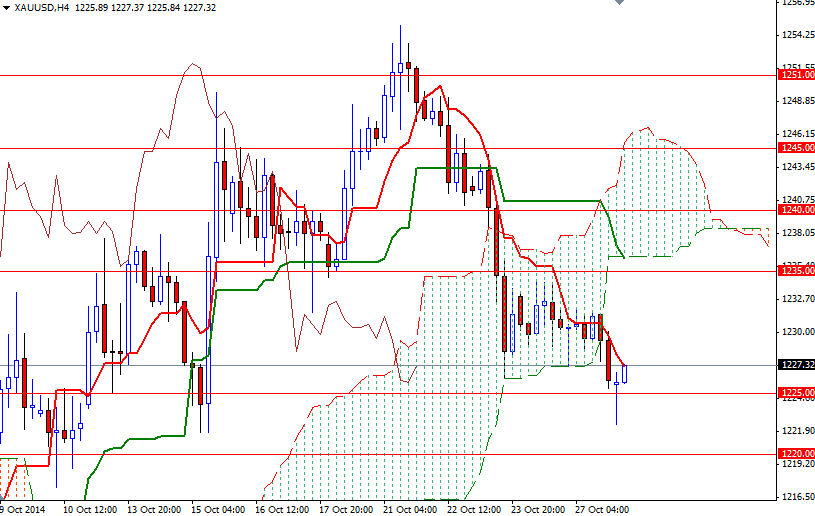

Based on the positioning of the Ichimoku clouds (on the weekly, daily and 4-hour charts), the odds favor the bears over the medium term but from a short term perspective the key levels to watch will be 1235 and 1220. The XAU/USD pair is trading between the Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-day moving average, green line) on the daily time frame and as you can see both lines are flat at the moment. This makes me think that prices will likely to be range bound until the announcement. The bears will have to drag prices below 1220 in order to march towards the 1212 level. Closing below this support on a daily basis would suggest that 1207/5 area will be tested soon after. Beyond the 1235 level, more resistance can be found at 1240. If the bulls manage to climb and hold prices above the 1240 resistance level, they might find another chance to revisit 1251.