Gold weakened against the American dollar on the back of upbeat U.S. economic data. According to the latest figures released by the Federal Reserve, industrial production advanced 1% in September. Separately, the Labor Department reported yesterday that the number of people filing new claims for unemployment benefits last week fell by 23000 to 264000.

It looks like the market is digesting recent gains and investors are keeping an eye on global equity markets. Although retail sales numbers pointed out softness in spending, the U.S. posted strong economic data over the past months so we were due for a pullback. Meanwhile, Federal Reserve officials are trying to reassure markets that they are not ready to start raising interest rates but the change is inevitable. Last weekend, Federal Reserve Vice Chairman Stanley Fischer said "If foreign growth is weaker than anticipated, the consequences for the U.S. economy could lead the Fed to remove accommodation more slowly than otherwise".

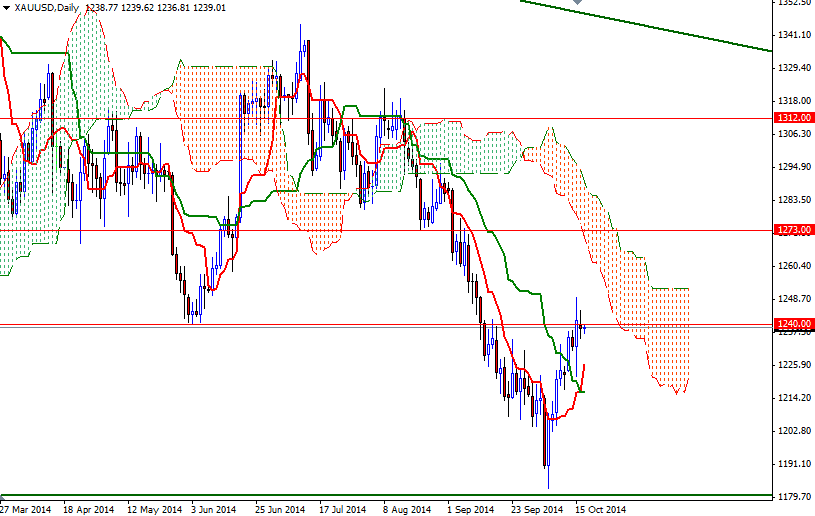

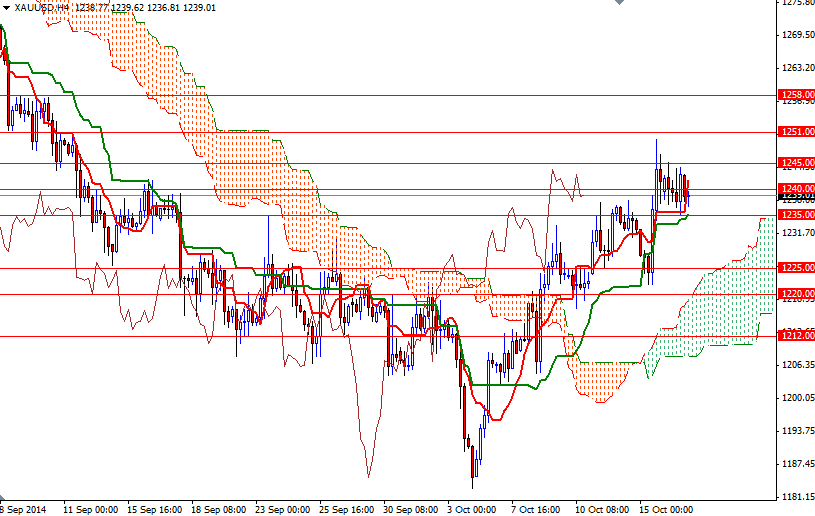

Looking at the weekly and daily charts from a purely technical point of view, the odds favor the bears in the long term. The market is trading below the Ichimoku clouds on both time frames and there is a big descending triangle in play. However, the XAU/USD pair is currently sailing above the cloud on the 4-hour chart and that suggest that the bullish reaction may not be over yet. With that in mind, I think the key levels to watch today will be 1235 and 1245. It is quite possible that the XAU/USD pair will gain some traction if it can push through the resistance at 1245. In that case, the bulls might a another chance to tackle the next barrier located at 1251. Closing beyond that hurdle would give the bulls extra momentum they need to reach 1258. If the bears take the reins and drag prices below the 1235/2 area, their next target will probably be the 1226.50/1225 support. A daily close below 1220 could increase the possibility of a bearish attempt to test the 1212 level.