Gold prices rose for a second-straight session on Tuesday as increasing demand for protection against volatility in the global equities drove up buying of safe-haven assets. Major stock markets ended the day in negative territory after the IMF cut its global economic growth forecasts for this year to 3.3% from 3.4% and German industrial output data came in well below expectations. If selling accelerates, investors might abandon stocks and flock to gold. Because of that I will keep an eye on equities as well.

The primary driver of gold prices today will be the headlines from the United States. Fed’s policy meeting minutes -which will be released later today- may shed more light on the timing of a future hike to interest rates. These records provide some useful insight into what the voting members were thinking at that time. Recently some officials voiced concerns over the potential risks of raising interest rates too soon. New York Fed President William C. Dudley said "It still is premature to begin to raise interest rates. The labor market still has too much slack and the inflation rate is too low. The consensus view is that lift-off will take place around the middle of next year. That seems like a reasonable view to me".

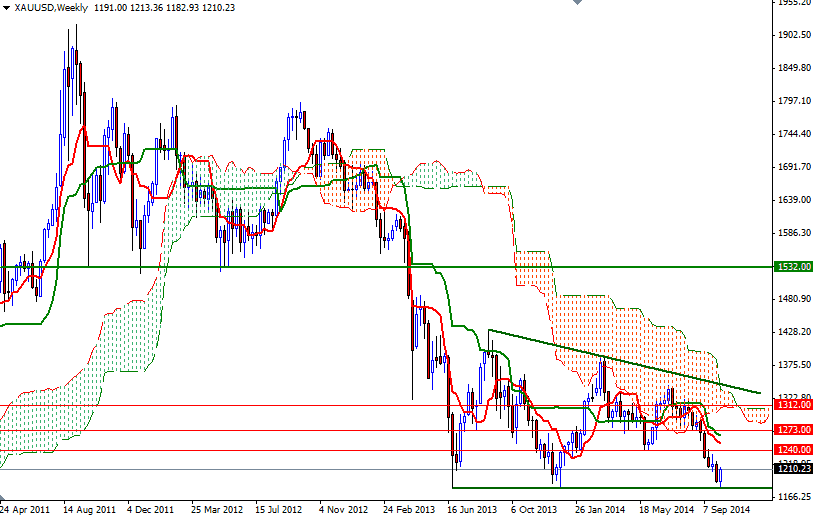

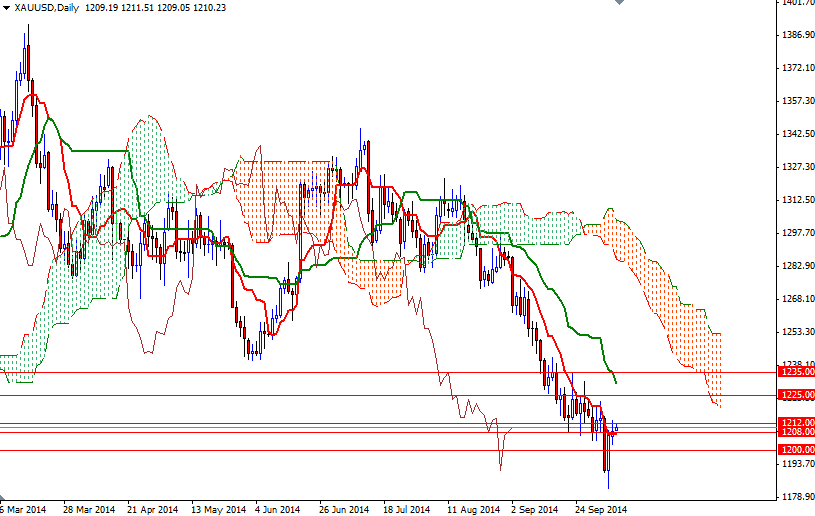

Looking at the charts from a purely technical point of view, the odds favor a range bound movement. On the shorter-term time frames there is a slightly bullish picture but the Ichimoku clouds are right on top of us on the 4-hour chart so technically I would expect to see some resistance in the 1215 - 1220.80 region. If the XAU/USD pair breaks through, we will probably see prices reaching the next stop at the 1225 level. The bulls will have to capture this strategic camp in order to gain more power and challenge the bears at 1235 and 1240. However, if they fail to penetrate the 1215/20.80 zone, the XAU/USD pair could reverse and test the supports at 1208 and 1202.60. Below that, the bulls will be waiting at the 1196 level.