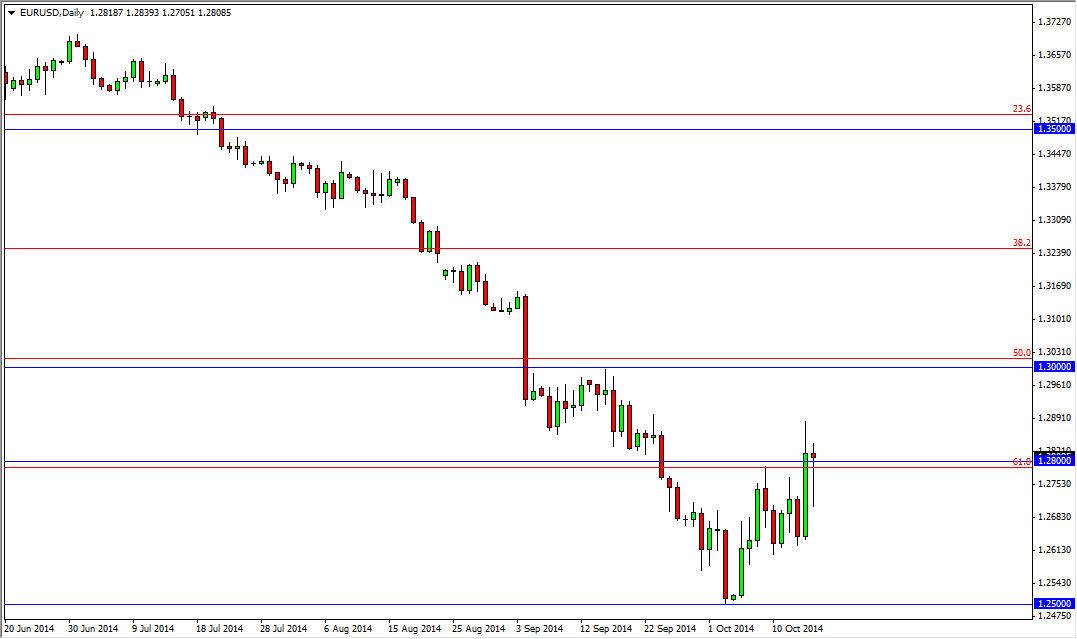

The EUR/USD pair initially fell during the session on Thursday, as the market reenter the previous consolidation area. The fact that we fell below the 1.28 level of course was a fairly negative sign, and something that I had anticipated seeing. With that being the case, I figure that the market would continue to fall from here, but something unexpected happened: buyers stepped in and pushed the market back above the 1.28 handle. With that, we formed a nice-looking hammer and it does of course suggests that the market is going to go higher from here. However, there are some complications.

If we break the top of the hammer, I would normally be fairly bullish. However, I see a significant amount of resistance all the way to the psychologically significant 1.30 level, and as a result I’m very hesitant to start buying. In fact, we may very well find yourselves on a break out to the upside simply reentering the consolidation zone yet again, with the floor been at the 1.28 level, and the ceiling been at the 1.30 handle.

Choppy times ahead

I believe that the market will continue to be choppy going forward, and with that it’s very likely that we enter this tight range and return to the old range bound trading feel that we normally have in this pair. Because of that, I think that it’s only a matter time before we settle back down and perhaps the trend slows.

All things being equal though, I still believe that the Euro will head to the 1.20 level given enough time. However, in a market that is so heavily traded it is hard to imagine that the market will fall drastically and in a quick manner as many people would have anticipated.

On the other hand, if we break down below the bottom of the hammer, I think that we had back to the 1.25 level, and then possibly lower than that. If we can break below the 1.25 level, I think that the move could accelerate little bit to the downside, but ultimately so a matter of time before it happens so you’re going to have to be patient for the larger move. On the other hand, if we do break above the 1.30 level, I feel that the market would then head to the 1.3250 handle.