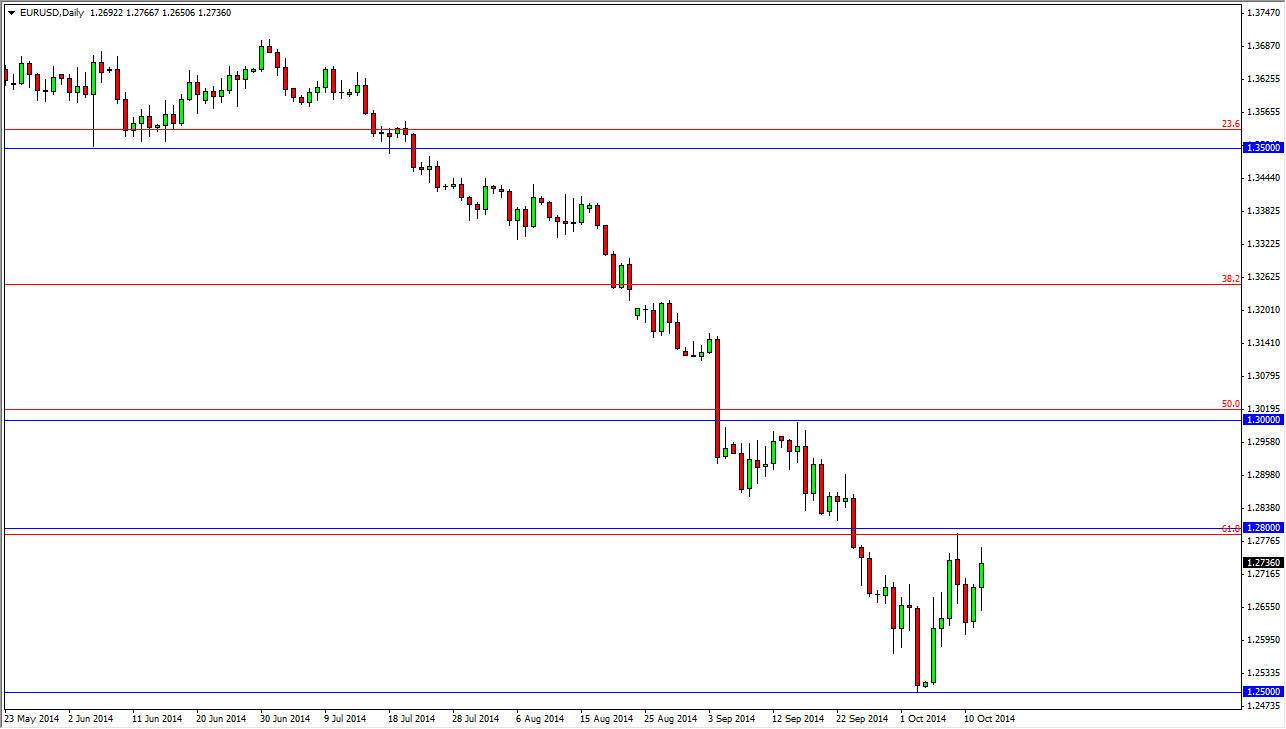

The EUR/USD pair tried to fall initially during the session on Monday, but as you can see the 1.2650 level offered enough support to push the Euro higher. However, we find yourselves just below the 1.28 level as a US dollar is still the favored currency around the world at the moment. I personally see the area above the 1.28 level as a thick “zone” that extends all the way to the 1.30 handle, and because of that I am actually looking for a resistant candle in order to start selling at this point in time.

If we get resistive daily candle, I would not hesitate sell, after all we have been in a vicious downtrend and I do not see that changing until at least above the 1.30 handle, and at that point in time I would still have to reassess the entire situation.

Relief rally?

This could be the simple mechanics of a relief rally as we have fallen so hard. The 1.25 level courses significantly supportive based upon the fact that it is such a significant number overall, but I do believe that we will eventually break down below that level. Yes, the US stock markets are suffering a bit at the moment, but it is because of global growth fears, most notably in the European Union. Because of this, I believe that the downward pressure on the Euro will continue to be the overall theme.

That being said though, short-term traders are probably trying to take advantage of longer-term traders clucking profits from the move lower. Ultimately, this market should find enough bearish pressure to push the Euro back down, and I still believe that it’s very likely that we could try to get as low as the 1.20 handle. As mentioned previously, a move above the 1.30 level would of course have me rethinking the entire situation, but I think at best a move above that level probably sends this market into more of a sideways type of feel. We do not have the making of an uptrend quite yet.