EUR/USD Signal Update

Yesterday’s signal to go short off a retest following a break below the lower channel trend line was triggered, although the set-up was not optimal on the H1 chart as the bearish formation came too late in the move. It was great on the M15 time frame with a bearish fat inside engulfing bar bouncing right off the broken trend line. In any case, if you had taken this short trade on the H1, you would already have some profit and have moved the stop loss to break even.

Today’s EUR/USD Signals

Risk 0.75%

Trades may only be taken prior to 5pm London time.

Short Trade

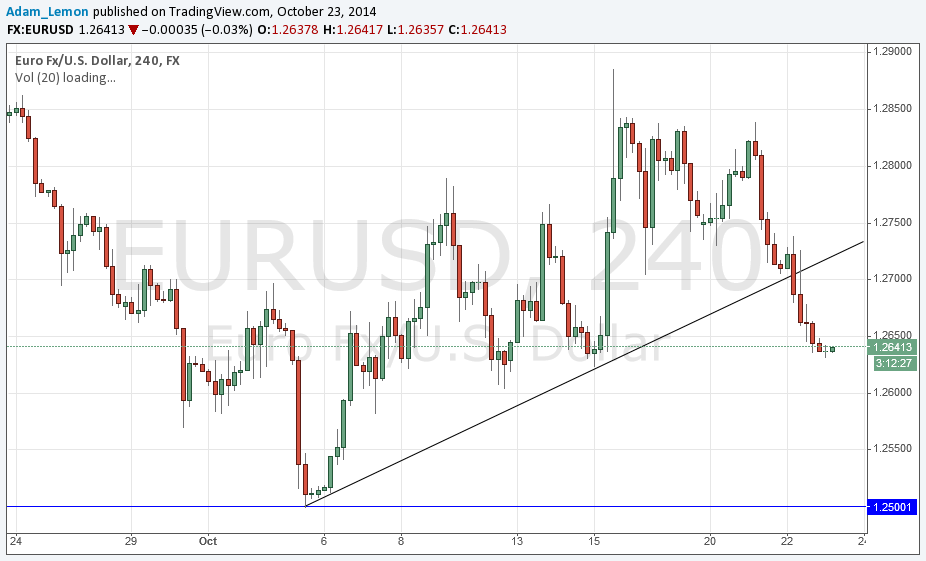

Short entry following bearish price action on the H1 time frame following a second retest of the lower channel trend line shown in the chart below.

Put the stop loss 1 pip above the local swing high.

Move the stop loss to break even when the trade is 25 pips in profit.

Remove 25% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

Long Trade

Go long following bullish price action on the H1 time frame following a first touch of 1.2500.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even when the trade is 25 pips in profit.

Remove 25% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

Yesterday’s scenario of a break below and a bearish retest of the lower channel trend line played out, and although the move down was reasonable it was not excessive. The fall has been driven more by weakness in the EUR than by strength in the USD.

It looks like my colleague Christopher Lewis’ bearish take was on the mark.

The daily chart suggests a further move down today. However there are really no key levels around between 1.2500 and the broken trend line above us, so it is difficult to forecast where that might happen.

We are near some local support so positive EUR news a little later might well push the price up 20 or 30 pips.

There are high-impact data releases scheduled today concerning both the EUR and the USD. Regarding the EUR, there will be releases of German Flash Manufacturing data at 10am London time followed by the French equivalent half an hour later. There will then be a release of US Unemployment Claims data at 1:30pm.