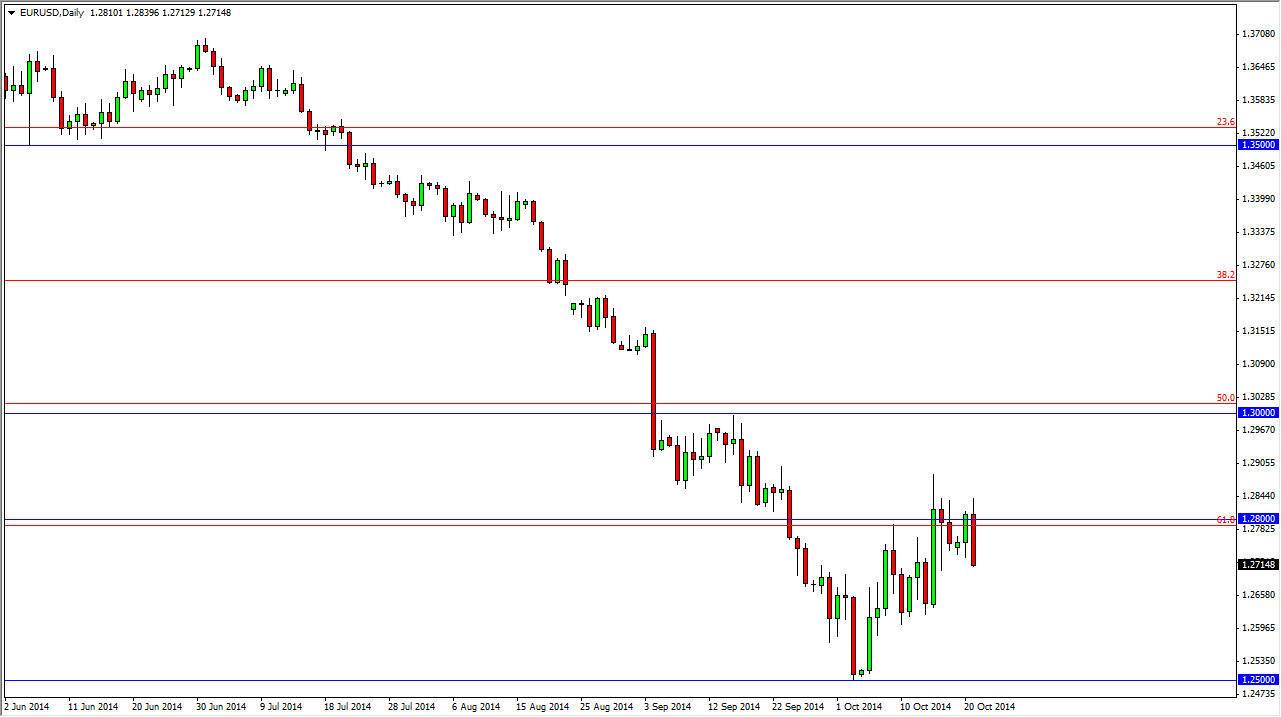

The EUR/USD pair initially tried to rally during the course of the day on Tuesday, but as we have seen several times in the past, the 1.28 level offered quite a bit of resistance and send the market lower. Because of this, it appears that the resistance barrier that I have talked about over the last several sessions continues to offer selling opportunities. In fact, I believe that the area between the 1.28 level on the bottom, and the 1.30 level on the top continues to offer enough selling pressure to keep this market negative.

On top of that, there is the possibility that we are trying to form a little bit of a bearish leg, which of course is a very negative sign in and of itself. The candle for the session on Tuesday close towards the bottom of the range for the day, and that tells me that the Euro continues to be very negative and should continue to fall over the next several sessions.

European Central Bank

The European Central Bank still looks as if it’s going to have to do something about the economy in the European Union, and that generally means loosening monetary policy. On the other side of the Atlantic, we have the Federal Reserve which has been stepping away from quantitative easing. Because of that, it makes sense that the pair should continue to go lower as demand for the US dollar increases. On top of that, the European economy itself is in exactly humming along, and with that it makes sense that more money is flowing into the US stock market as well.

Because of this, I believe that this market will continue to drop and we will eventually test the 1.25 handle yet again. That area should be rather supportive though, so I think it will take several different attempts to break down below that area. However, if we do I think that the market then heads down to the 1.2050 region, where we started the uptrend that we have now fallen from recently.