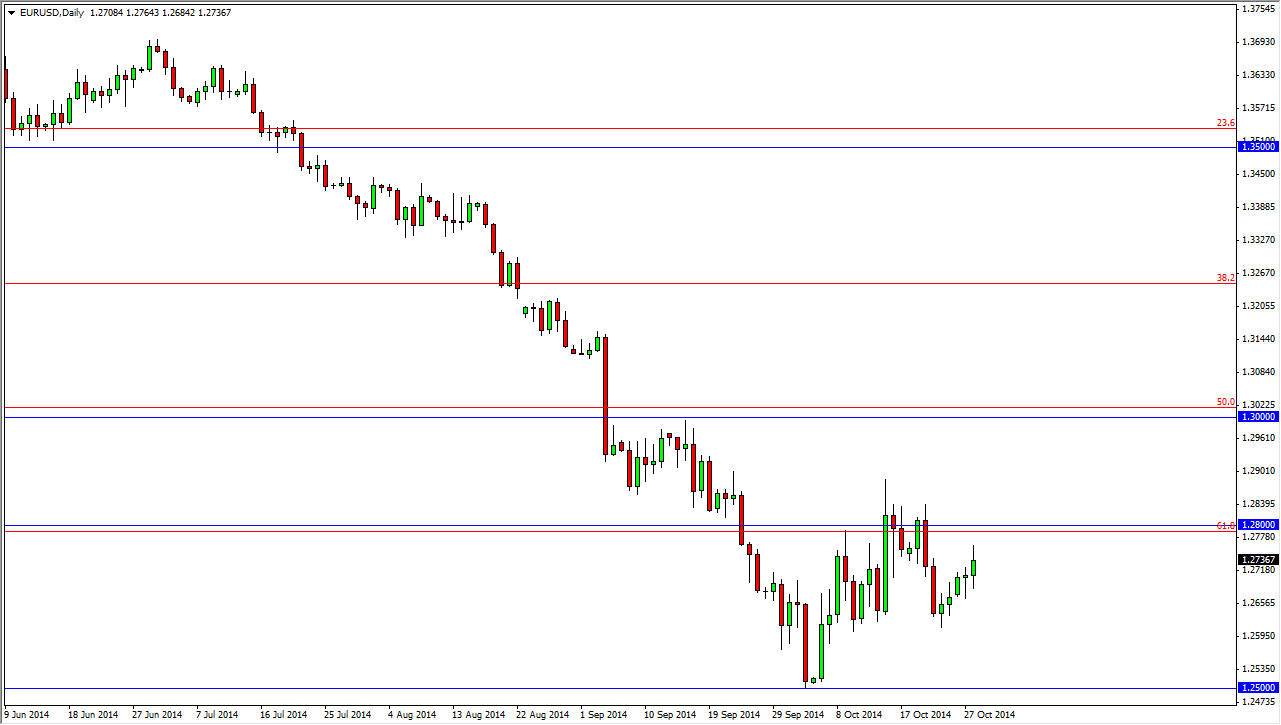

The EUR/USD pair continues to test the 1.28 handle, an area that I believe will bring in a lot of selling. I believe that the area between the 1.28 level and the 1.30 level offers a significant amount of selling pressure, and with that I feel that the market should continue to be one that you can sell time and time again as we approach this area. With that being said, the market looks as if it trying to form a little bit of a shooting star for the session on Tuesday, and as a result Wednesday could see some selling.

Looking at this chart, the one thing you need to keep in mind is that the Federal Reserve has an interest rate decision coming out today, as well as a statement. It’s the statement that the market will be paying attention to as it could give us hints as to whether or not the Federal Reserve will continue to be hawkish, or if they will turn around and loosen monetary policy. That being the case though, expect a lot of volatility but I do think that this pair will continue to sell off and today could be the catalyst that we are waiting for.

I still look at rallies as potential selling opportunities

I believe that the rallies that we see in this marketplace should continue to offer selling opportunities again and again, and as a result the market is one that I have no interest in buying. In fact, I have absolutely zero interest in buying this market until we get above the 1.30 handle, something that isn’t going to happen anytime soon.

The market should then head to the 1.25 level after a resistant candle or perhaps a strong statement out of the Federal Reserve today. Sooner or later, I believe that we break down below the 1.25 handle and head to the 1.2050 level which would be a complete “round-trip” of the uptrend that we have just smashed through. I believe that short-term traders will continue to push this market lower and I could also make a bit of an argument for a bearish flag being formed at the moment.