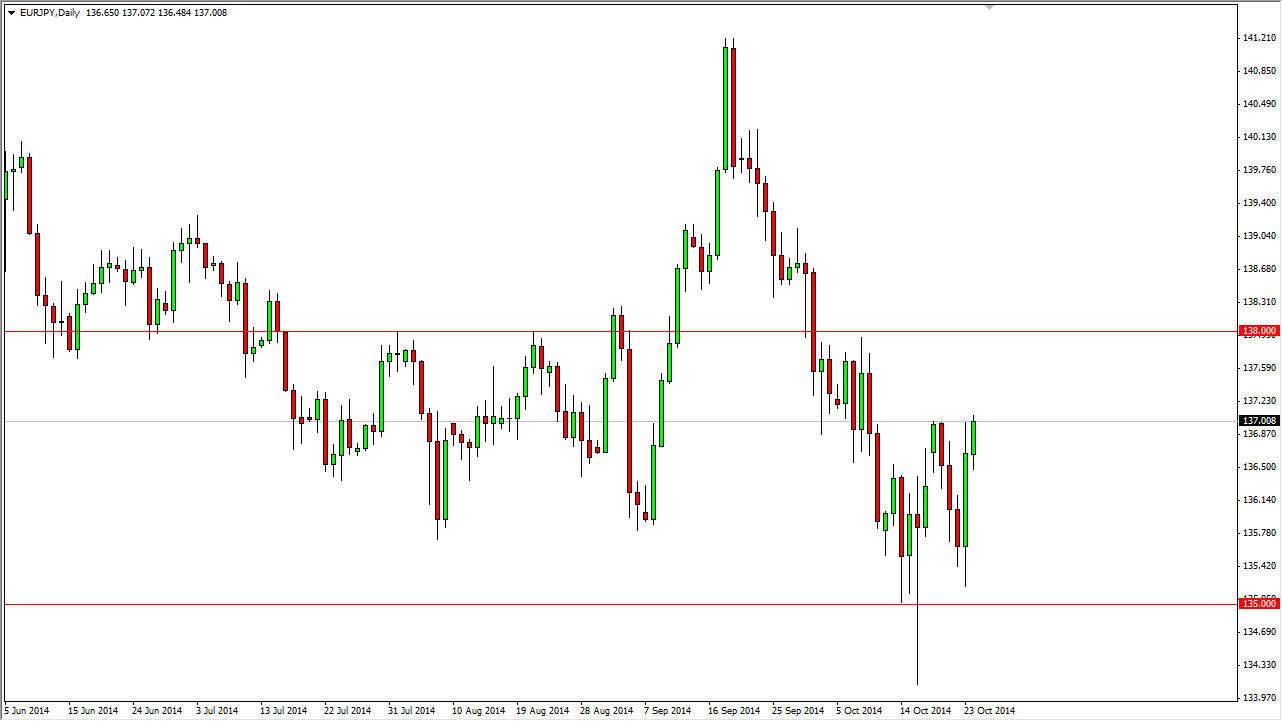

The EUR/JPY pair is starting to show signs of life at the 137 handle, as we pressed up against pretty significant resistance. With that, it appears that the market should continue to go higher, but I recognize that the 138 level above is more than likely going to be pretty significant resistance as well. Because of that, I believe that short-term traders will continue to push this market higher, and I also believe that a pullback here or than likely will find plenty of buying pressure as the 135 level below is massively supportive on not only the daily chart, but the longer-term charts as well.

I believe that the pair will continue to be a buying opportunity going forward, as long as we can stay above the 135 level. I think that pullbacks only offer value at this point in time, mainly because the Japanese yen is being sold off so aggressively around the world. In fact, I believe that this pair has more to do with the Yen than the Euro, so essentially I believe it is somewhat insulated against the trouble in the European Union at the moment.

Much higher levels

I believe that there are much higher levels ahead, and that the market will more than likely head to the 140 level. That’s an area of that of course will attract a lot of attention because it is a big, round, psychologically significant number, but ultimately I also believe that the Japanese yen will continue to be sold off by almost everybody, and as a result we should continue to see this market going much higher.

I also believe that this could be the beginning of a longer-term uptrend, but recognize that the troubles in Europe of course are going to make this a slower moving pair than some of the other Japanese yen related markets. I am bullish of this market, but also recognize that it’s probably easier to go long of the GBP/JPY pair or maybe the USD/JPY pair as those are two currencies that are bit stronger than the Euro.