By: Ben Myers

Bitcoin experienced a very positive development as the state of NY ruled that developers working on software for the crypto-currency would not require a license going forward. This is being seen as a huge victory as it takes away regulatory hurdles. Additionally, Bitcoin found a supportive voice in the Australian Senate. Senator Sam Dastyari provided his full support to the digital currency and strongly believes that all financial intermediaries should provide feedback on how to incorporate and regulate the digital currency in order that it should be adopted by the masses.

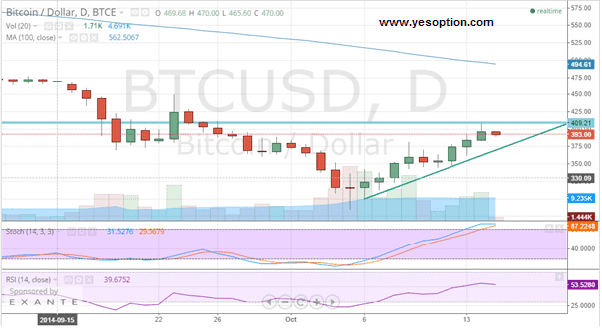

BTC/USD was unable to scale the all-important psychological resistance zone of $400 and witnessed selling pressure which pushed prices lower. The weakness continued in the Asian- morning trading session with the digital currency trading flat, but with a negative bias. The BTC/USD is currently trading in an upward trending channel but has found resistance at higher levels.

The crypto-currency continues to trade below its daily moving averages and the stochastic oscillator for the BTC/USD has show first signs of a reversal. The relative strength index has given a clear sell signal, pointing towards an impending correction in prices. Support for BTC/USD continues to remain near the $372 level, which is the upward sloping trendline.

Actionable Insight:

Short BTC/USD below $372 for an intermediate target at $300 with a strict stop loss above $400

Long BTC/USD only it manages to move above $400 for a short-term target at $442 with a strict stop loss below $370