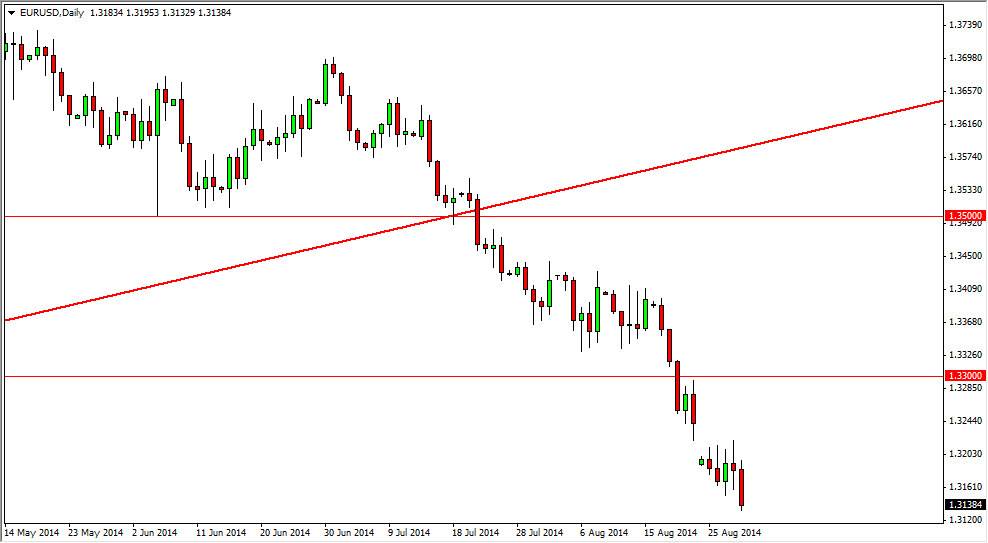

The EUR/USD pair fell during the course of the day on Friday, breaking down towards the 1.321 level, an area that in my estimation is a minor support level at best. The gap that formed at the beginning of last week tells me that this market still has plenty of bearish pressure, and as a result I believe that the market will still aim for the 1.30 level in the near term. Because of this, I am still selling rallies as they appear, since the European Central Bank is more than likely going to be forced to add some type of quantitative easing.

There are various European numbers coming out this week that can greatly influenced this pair, but unless we break above the 1.33 handle, I don’t see any real significant way to start buying this market. Between here and there, I will short every resistive looking candle as the downtrend is without a doubt firmly established. Because of that, I think that traders will continue to return to this market time and time again in order to jump on top of the weak currency.

Solid looking candle.

There’s a pretty solid looking candle for the Friday session, as we have closed towards the very bottom of the range. With that, it appears that there should be a bit of continuation as is the norm when you do such things. However, the 1.31 level could cause a little bit of a bounce in the short-term, but again, I realize that this is more than likely just going to offer value when it comes to the US dollar.

Ultimately, I think that the 1.30 level will be targeted, but I also believe that we go as low as the 1.28 level, as it is a much more supportive and significant area on the longer-term charts. The area should continue to be attractive to traders, and as a result I believe that the sellers will push towards it, while the buyers should step into the marketplace and take advantage of it as an obvious support area.