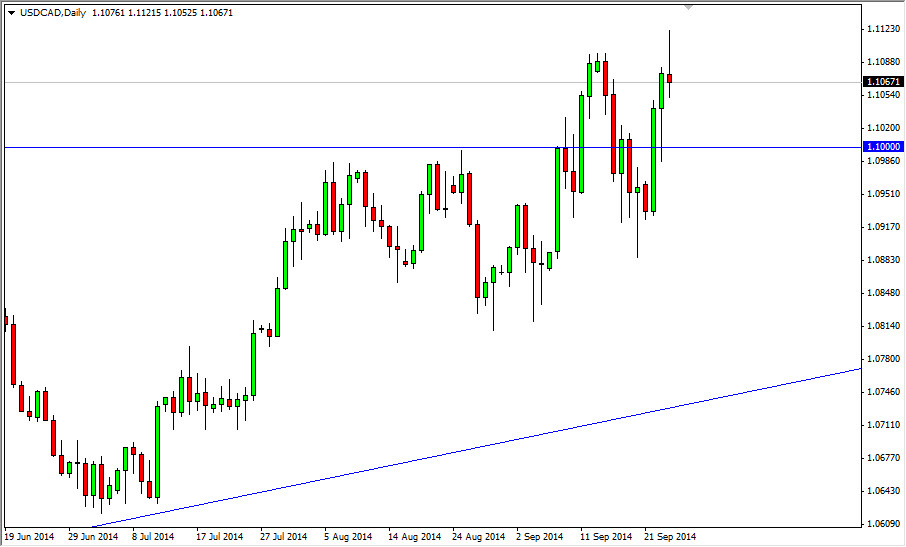

The USD/CAD pair tried to break down during the session on Wednesday, but as you can see struggled just above the 1.11 level during the course of the day. On top of that, the market is at the top of a larger consolidation area, so therefore it’s not a big surprise if we pullback from here. If we do pullback and break the bottom of the shooting star for the session, I believe that the market will fall at least to the 1.10 level, or possibly even the bottom of the consolidation area which I see as the 1.09 level.

If we break down below the bottom of the shooting star from the Wednesday session, I think that selling is still going to be impossible, basically because the Canadian dollar isn’t quite acting correctly. The oil markets certainly aren’t helping, as they typically drive the Canadian dollar back and forth.

Further consolidation

I believe that we are going to see consolidation time and time again in the meantime, unless of course we break above the top of the shooting star, which of course would be very bullish sign. I do believe that ultimately we go to the 1.12 level though, just a matter of time in my opinion. With that, I like the US dollar overall, although this pair does tend to be rather choppy in general, simply because the two economies are so intertwined, therefore the markets tend to reflect that.

With Core Durable Goods numbers coming out during the session out of America, we could very possibly see a bit of a move in this marketplace. On top of that, the Initial Jobless Claims comes out, and that can move the value the US dollar as well. Regardless, I think that a pullback at this point in time is the opportunity that you need to take advantage of perceived value in the US Dollar overall. I find it very difficult to find a reason to sell this pair, especially considering that we have a nice uptrend line just below the current clustering.