During yesterday's session gold prices initially fell to the lowest level since the beginning of the year but moved back up after the bulls managed to defend the 1208 support level. The pair traded as high as $1220.30 an ounce after the existing home sales figures fell short of market expectations. According to the report released by the National Association of Realtors, sales of existing homes fell 1.8% in August.

Also comments from New York Fed President William C. Dudley helped providing a lift to gold. Dudley said, "I'd like to raise interest rates at some time during my tenure... but I'm not going to raise interest rates just for the sake of raising them... We really need the economy to run a little hot for at least some period of time". Today the XAU/USD pair is trading in a relatively tight range as investors are awaiting the release of the manufacturing PMI data out of China, the world's biggest gold consumer.

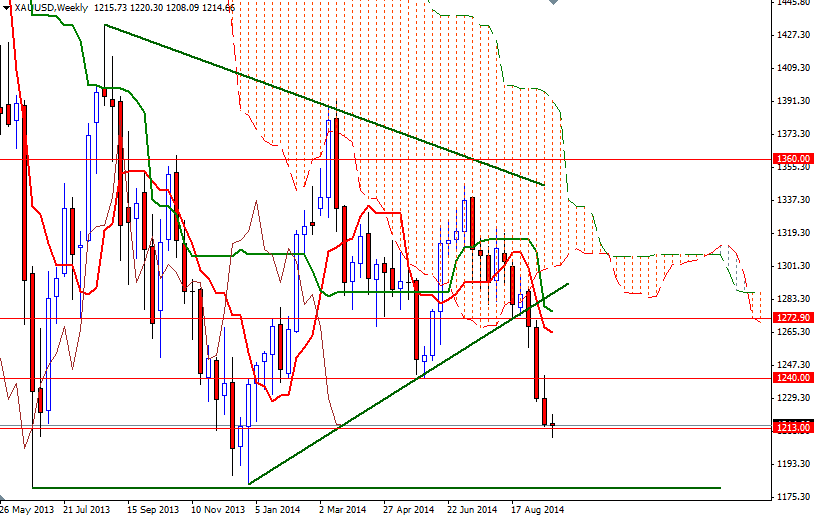

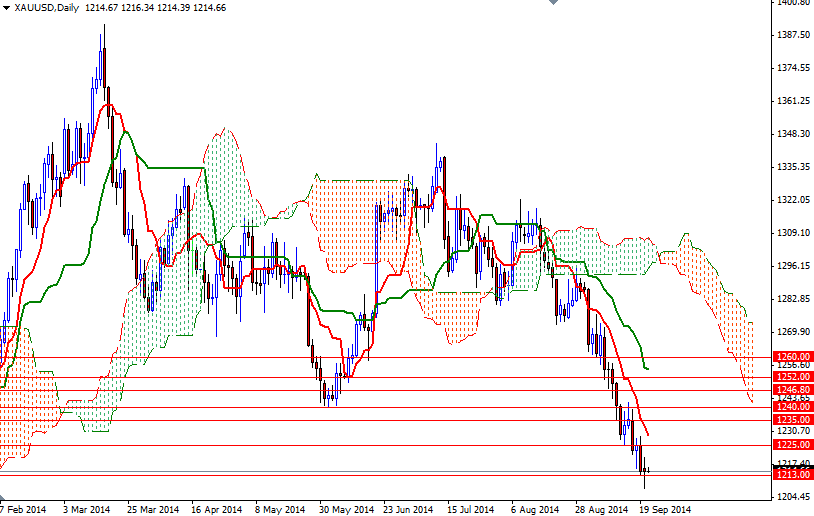

The overall sentiment remains bearish but the recent price action indicates that the war between the bulls and bears has intensified. Therefore I wouldn't rule out a bounce towards the 1225 level. In the near-term I will be watching the 1225-1208 zone. If the bulls manage to hold the market above the 1213 level today, they may have a chance to tackle the 1222/5 resistance. Beyond that, expect to some resistance at 1229 level where the Tenkan-sen line resides on the daily time frame. Buyers will need to break through this first critical barrier in order to challenge the bears at 1235. In order to increase downward pressure, the bears will have to drag the market back below 1213. If that is the case, the market's focus will turn to the 1208 support level. A successful close below 1208 means 1200 will be the next target.