Gold prices settled slightly higher yesterday, extending gains from Monday's session, as weakness in the American dollar lured some investors back to the market. Since mid-July the biggest influence on the gold price has been improving U.S. economic data which would eventually prompt the U.S. Federal Reserve to shift to a more hawkish tone on interest rates. The XAU/USD pair has been trading in a relatively tight range during today’s Asian session as investors are waiting for the outcome of the Federal Open Market Committee meeting.

A few months ago the Federal Reserve telegraphed that the first rate hike is likely to come around the middle of 2015, as long as the recovery remains on track. However, the Fed is growing its balance sheet over $4 trillion and that will be a big burden when it is time to unwind this accommodative policy. The central bank could use the meeting to clarify its plan for rate rises, whether in the official statement or in Chair Janet Yellen's press conference.

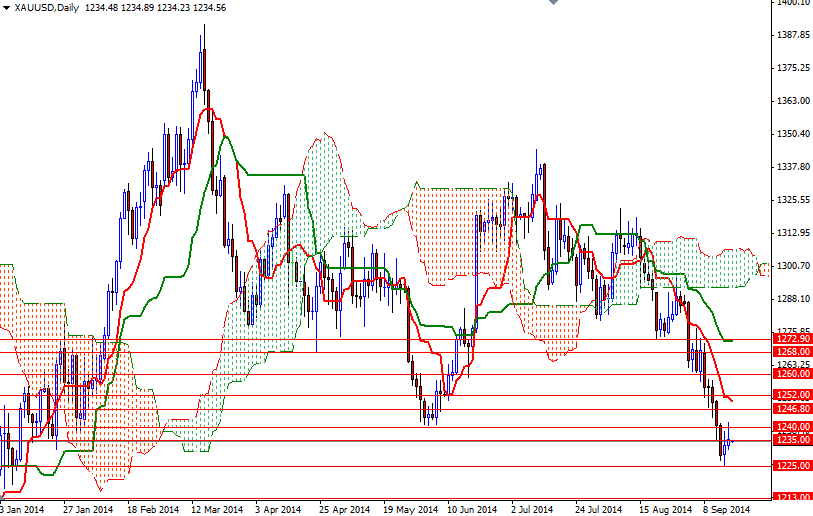

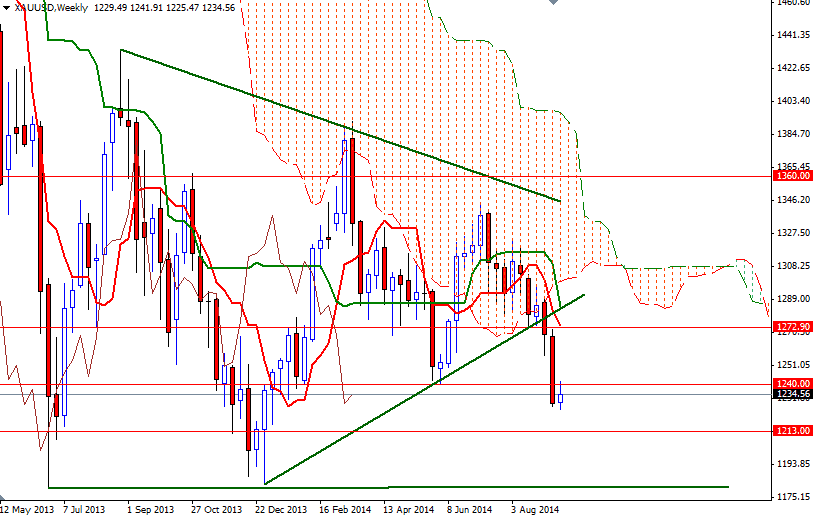

From a technical point of view, short term charts suggest that a retest of 1240/2 is likely if the XAU/USD pair manages to climb and hold above the 1235 level. If the Federal Reserve meeting results in a dovish policy outlook and prices can break through 1240/2, the pair may extend its gains and head towards the 1246.80 - 1252 area. To the downside, I will be focusing on the support at the 1225 level. In order to confirm a stronger move, look for prices to close below that support level. In that case, I think the bears will be aiming for the 1213 level next.