The XAU/USD pair closed higher than opening, snapping five consecutive days of losses, as investors started the week by taking some of their recent profit off the table. A recent string of encouraging U.S. economic data has stoked speculations the Federal Reserve may act sooner to hike interest rates. The precious metal has been also experiencing a lack of safe-haven demand, with the situation in eastern Ukraine having stabilized.

Yesterday's price action indicates that investors aren’t interested in going too far out on the risk spectrum ahead of the Federal Reserve's two-day policy meeting which begins today. The central bank will provide new economic projections, and Chair Yellen is scheduled to give a post-meeting press conference. While some feel that good economic data will give Fed the confidence to normalize the monetary policy, others think that the Fed has the luxury to keep policy accommodative as long as inflation remains under control.

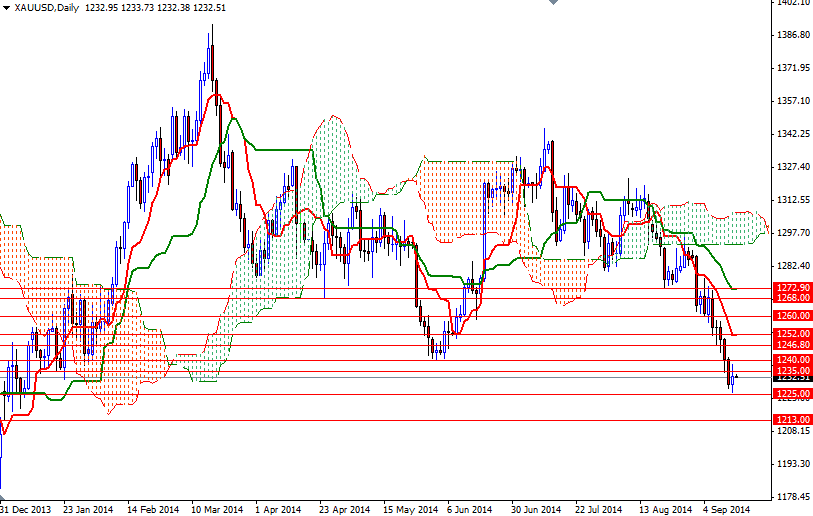

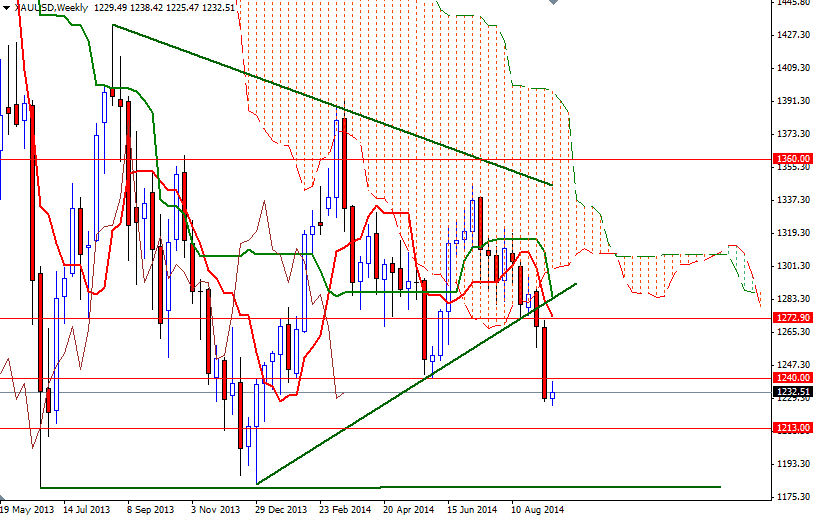

From an intra-day perspective, the key levels to watch will be 1225 and 1240. During today's Asian session the XAU/USD pair is trading between the Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-day moving average, green line) on the 4-hour time frame and both lines are flat at the moment. If short-side profit taking continues and the market climbs above the 1235 level, it is very likely that we will see the 1240 resistance being tested. I think penetrating that barrier is essential in order to test the next resistance at 1246.80. A drop below 1225 would place control back in the paws of the bears as we head towards the 1213 support level. On its way down, an interim support can be found at 1218.