Gold lost ground against the American dollar for a third consecutive session on Wednesday, with diminishing concerns surrounding Russia and Ukraine contributing to another rally in U.S. equities, ahead of the much anticipated meeting of the Federal Open Market Committee next week. Ukraine's President Petro Poroshenko said "According to the latest information I have received from our intelligence, 70% of Russian troops have been moved back across the border. This further strengthens our hope that the peace initiatives have good prospects" during a cabinet meeting.

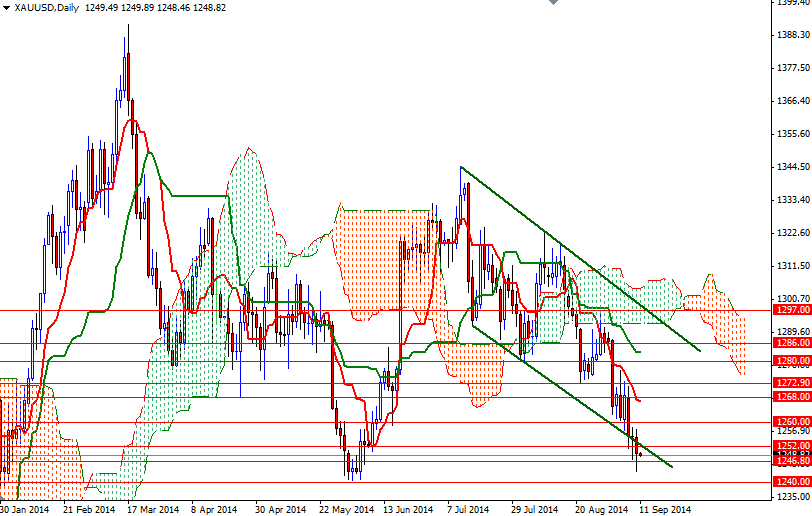

European Union foreign ministers meeting yesterday showed that some nations want to impose more sanction on Russia immediately while others want to allow more time for the peace process and see if the ceasefire became permanent. Meanwhile, technical selling pressure continues to weigh on the market. Yesterday, the bulls' failure to push prices above the 1259/60 area lured sellers back to the market and helped the metal deepen its losses from the previous sessions.

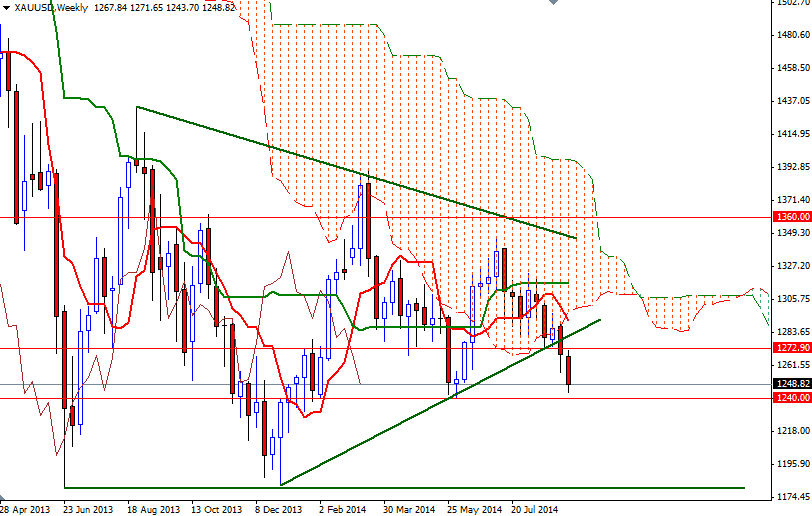

The broader directional bias remains weighted to the downside while the market remains below the Ichimoku cloud on both the weekly and daily time frames but I think the area between 1246.80 and 1240 will play an important role going forward. Honestly, I was expecting to see a bounce (towards the 1268 level) around these levels but prices have to climb above the 1259/60 resistance to support this theory. Otherwise, I will be watching the support at the 1240 level. A sustained break below this important support level could increase speculative selling pressure. In that case, 1235/1 1225/4 and 1213 will be the next possible targets for the bears to capture.