The XAU/USD pair initially fell to its lowest level in eight months during yesterday's session but erased losses and ended the day slightly higher after a series of economic data released from the United States came out weaker than forecasts. The Commerce Department’s report showed that building permits dropped 5.6% to 998K in August and housing starts fell 14.4% to 956K. The Labor Department said that the number of first-time applicants for jobless benefits decreased 36K to 280K and data released by the Federal Reserve Bank of Philadelphia revealed that its manufacturing index dropped to 22.5 from 28.0.

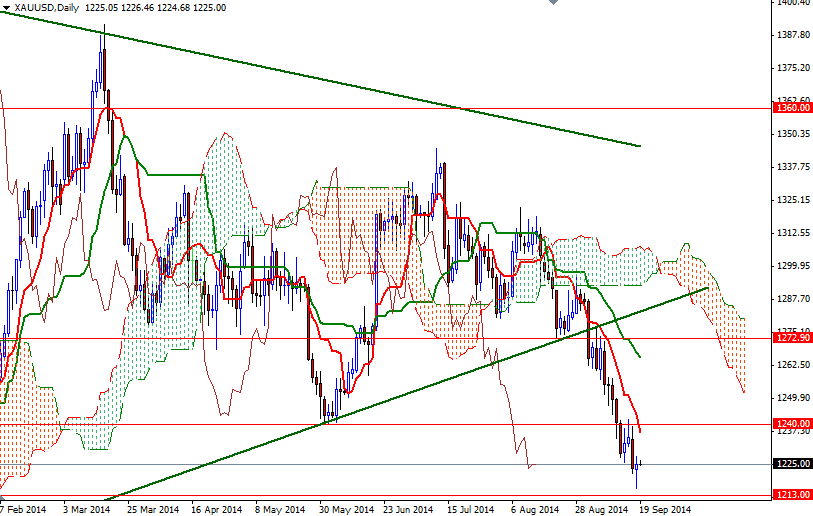

Final results from the Scottish independence referendum will be coming soon but the newspapers are calling a "No" vote victorious already. Fading threat of a break-up of the United Kingdom and continued rise on stock exchanges could limit gold’s potential upside. Technically speaking, the odds favor the bears over the medium term because prices are moving below the Ichimoku cloud and we have bearish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) crosses on the weekly and daily time frames. In addition, trading below the 1240 support level -which caused prices to reverse in June- creates a certain amount pressure on the market.

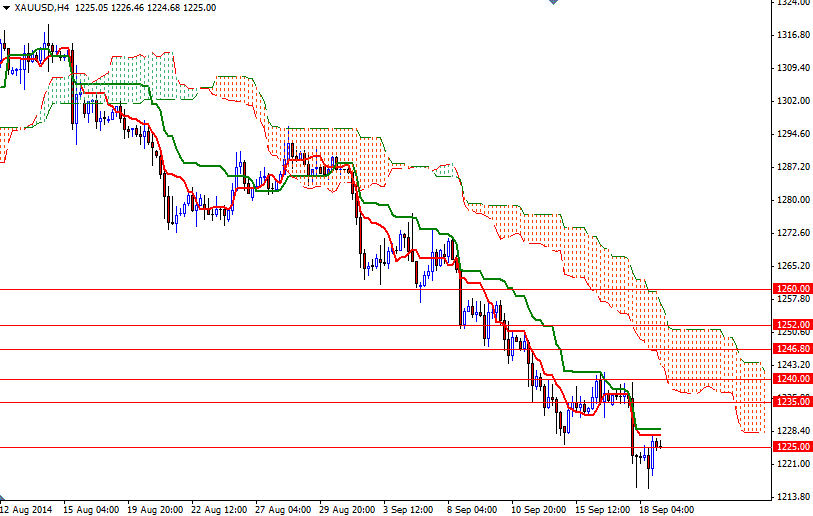

From an intra-day perspective, I think the key support-resistance zones to watch will be 1227.55/1228.87 and 1215.40/1213.00. The bulls have to push prices above the 1228.87 (the Kijun-sen line on the 4-hour chart) in order to gain enough momentum to test the 1235 and 1240 levels. If the bears continue to dominate the market and the XAU/USD pair makes a sustained break below the 1213 level, then there is a strong possibility that the market will sink deeper and head towards the 1203 - 1296 area.