Version:1.0 StartHTML:0000000167 EndHTML:0000002447 StartFragment:0000000457 EndFragment:0000002431

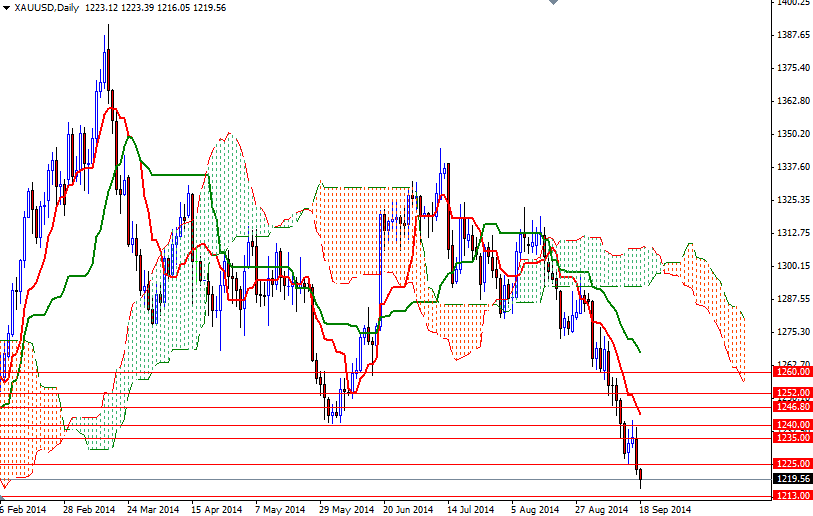

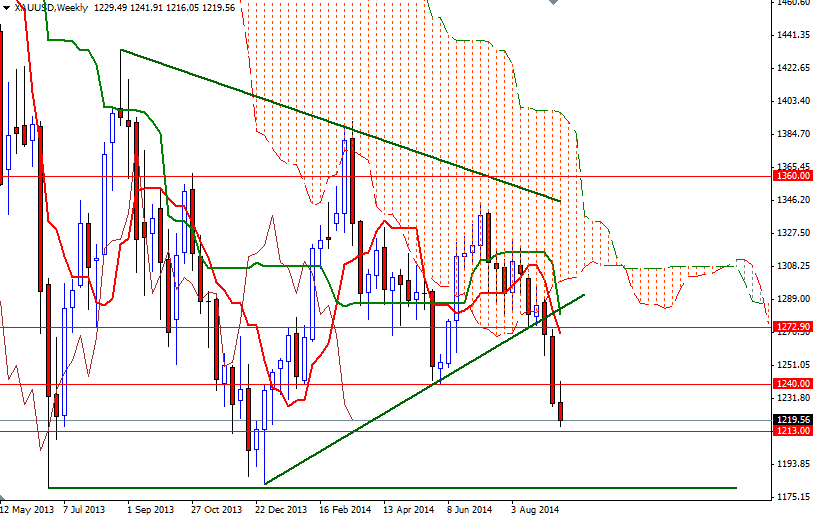

The XAU/USD pair (Gold vs. the American dollar) closed yesterday's session with a loss as the American dollar gained some strength across the board. Gold prices fell sharply and gave back all of the gains made over the past two sessions after Federal Open Market Committee members raised their estimate for where the federal funds rate will be by the end of the next year to 1.375% from 1.125%.

The Federal Reserve announced that it will trim monthly purchases by another $10 billion to $15 billion and end its current program at its next meeting if incoming information broadly supports the Committee's expectation of ongoing improvement in labor market conditions. The markets were hoping to hear more than what was in the official statement during Fed Chair Janet Yellen's press conference but she reiterated that the timing of the first rate rise is data dependent (i.e. there is no rush so don't expect any meaningful moves anytime soon).

Prices have been bearish during the Asian session but we are approaching a critical area of support around the 1213 level and the referendum on Scotland's independence is turning the market’s focus away from the U.S. economy to Europe. If the Scots elect to be an independent country, we could see some short-covering. The first hurdle gold needs to jump is located around the 1225 level. If the bulls manage to push and hold prices above this level, they might have a chance to start a journey towards the 1235/2 area. However, closing below the 1213 support level means there is a strong possibility that the bearish trend will resume and the bears will be challenging the bulls on the 1203 - 1296 battlefield.