Gold prices settled at $1229.24, dropping 3.04% over the course of the week, as strength in the U.S. dollar and equity markets outweighed geopolitical tensions. The XAU/USD pair traded as low as $1227.50 an ounce after data released by the University of Michigan showed that the preliminary index of consumer sentiment climbed to 84.6 from a final August reading of 82.5 and the Commerce Department reported that retail sales rose 0.6% in August.

Expectations the Federal Reserve will take a more hawkish tone on interest rates are driving this market’s bearish activity but I think lackluster physical demand from Asia is another element working against the precious metal. India is not considering to ease the restrictions on gold import and China is expected to buy 1000 tons of gold this year, down from 1275 tons last year. Meanwhile, Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions (for a fifth consecutive week) in gold to 95141 contracts, from 96879 a week earlier.

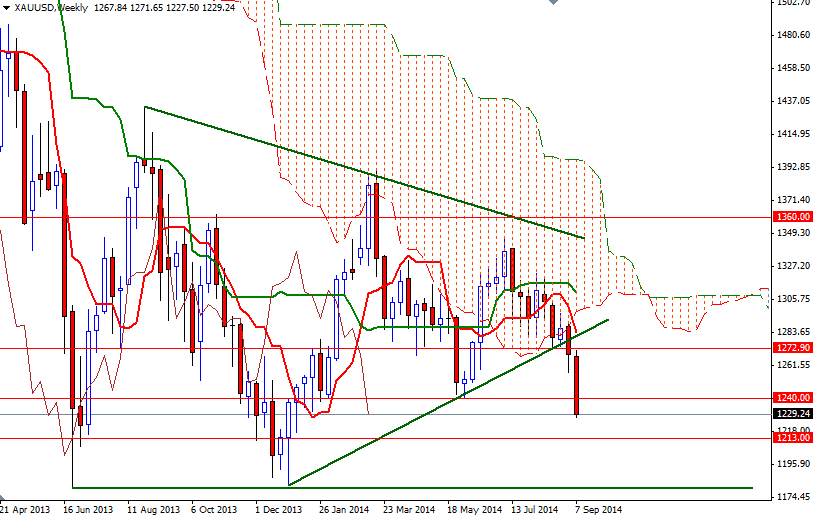

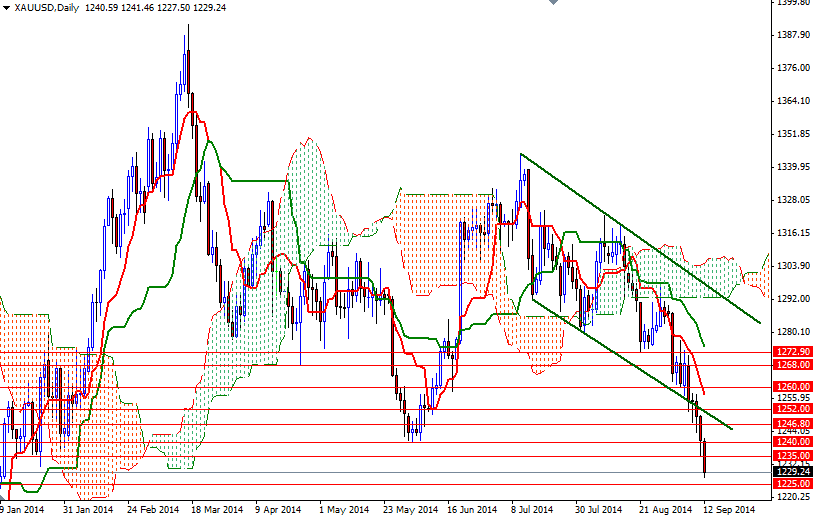

Technically speaking, last week’s decline could be the beginning of a much more serious sell off. The weekly chart is also hinting at possible lower prices as that market closed back below the 1240 support level. The pair is most likely headed for the former support at 1218/3 if the bears are able to maintain control but of course 1225/2 will be a key area to watch. Closing below the 1213 level would make me think that the 2013 low of 1180 will be challenged. However, if some investors want to reduce their risk ahead of the Fed meeting, it is likely that we will see the XAU/USD pair testing the resistances at 1235 and 1240. Beyond 1240, the bears will be waiting at 1246.80.