Gold prices settled higher on Thursday, rebounding from an eight-month low, with the metal’s attractiveness as a safe-haven asset in the wake of a sharp drop in U.S. equities offsetting pressure from strength in the American dollar. In the latest economic data, Markit's services purchasing managers' index came in at 58.5, down from the previous month's (revised) 59.5 and below expectations for a reading of 59.4. The Labor Department reported that the number of first-time applicants for jobless benefits climbed 12K to 296K and data released by the Commerce Department showed that demand for all durable goods slumped 18.2% in August.

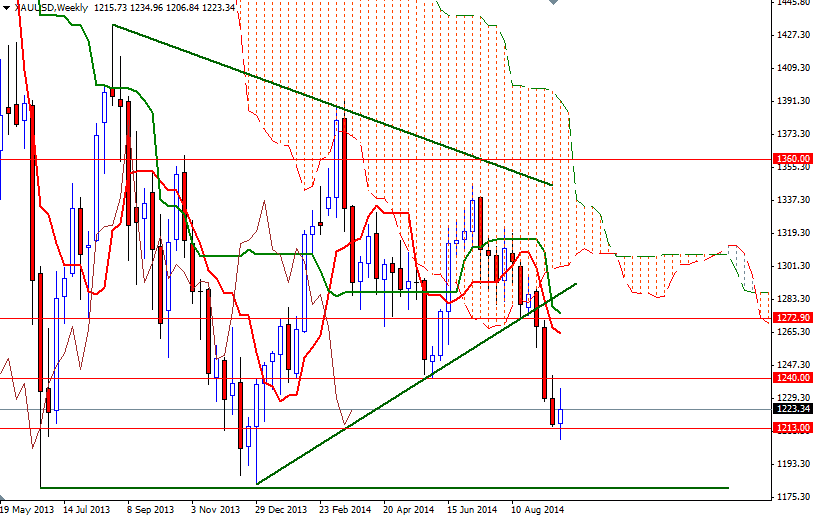

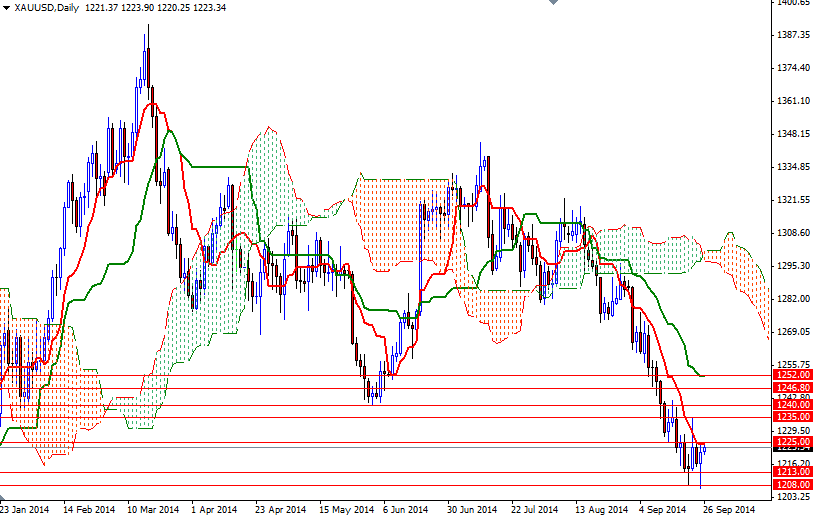

Yesterday's candle indicates that the bulls won't give up defending the 1213/08 area which I pointed out as a strategic point for a bearish continuation. Because of that I will focus on the 1225/9 resistance zone today. We have a bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) cross on the 1-hour chart but the XAU/USD pair is approaching to the Ichimoku clouds on the 4-hour time frame.

The market has traveled quite a distance since the technical outlook on the daily chart became extremely negative. So it is possible to feel some pressure from short-side profit taking if the market can penetrate the cloud (4-hour chart). If that is the case, I think the bulls will be aiming for the next barriers at 1235 and 1240. To the down side, there is an interim support between the 1220 and 1217 levels. If prices drop below that, we may revisit the support at 1213. Breaking below 1208 on a daily basis would increase the downward pressure and open the doors to 1200, at least.