GBP/USD Signals Update

Yesterday’s signal was not triggered as although we did reach 1.6278, there was no strong rejection of this level during the London session.

Today’s GBP/USD Signals

No signal is given today.

GBP/USD Analysis

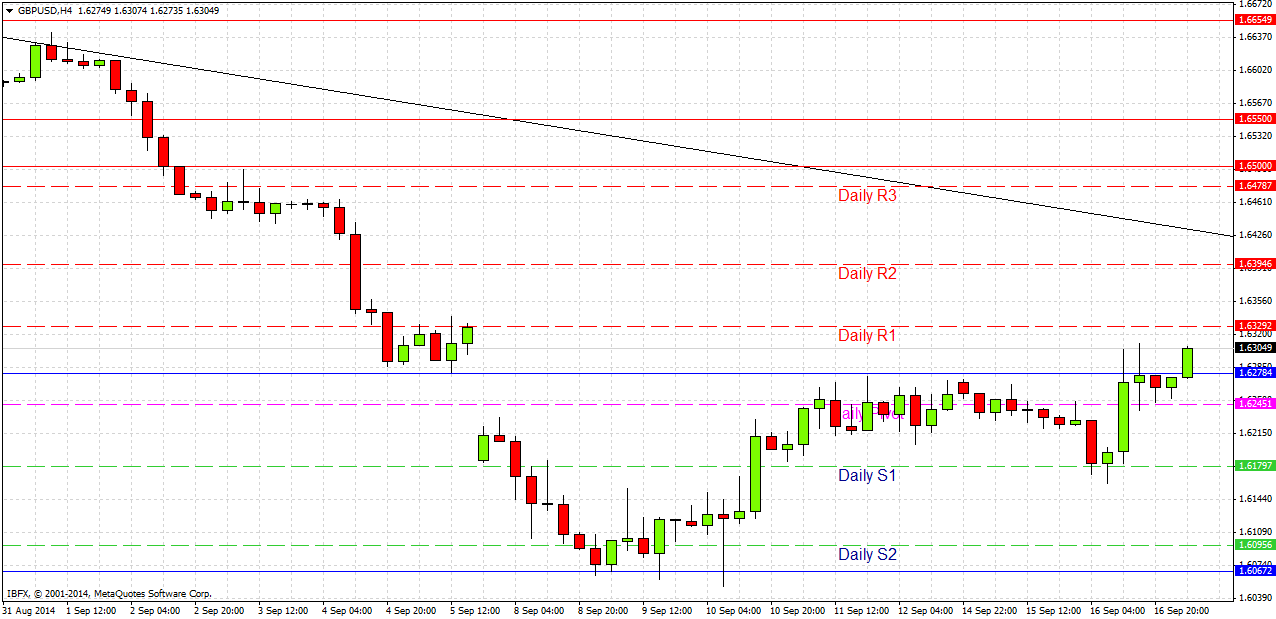

We seem to have broken above the previous resistance at 1.6278, which is a bullish sign. The GBP has been showing some strength across the board over recent hours, so technically there is a suggestion that a move up is likely, especially if we break up past 1.6330 next.

Unfortunately, technical analysis is going to be dangerous to follow over the coming 36 hours or so as we have a big run of fundamentals coming, which are capable of providing all kinds of wild shocks to both the GBP and the USD, especially the GBP. The most important data releases of the month concerning the GBP are being released during today’s London session, then later the second most important US data of the month will be released, and to cap it all off there is a vote tomorrow on whether Scotland will break away from the UK which might fundamentally change what the GBP is.

Currently, opinion polls are showing that Scotland will vote to keep the status quo of remaining within the UK by a margin of 4%, and this is probably what is driving the cautious bullishness which we see in the GBP. However this lead is quite narrow and there are a fair number of undecided voters. We can expect a fairly accurate exit poll at around 10pm UK time on Thursday, and it will probably be at this point that the best trade becomes most obvious, barring any shocks when the votes are actually counted.

Before that time, it could be a good trade idea to short any news-driven spikes up to the bearish trend line, which currently sits at around 1.6425 as shown in the chart below.

There are several high-impact events scheduled today concerning both the GBP and the USD. At 9:30am London time there will be releases of several pieces of key U.K. data: Average Earnings Index, Claimant Count Change, MPC Asset Purchase Facility and Bank Rate Vote. Later at 1:30pm there will be a release of US Core CPI data, followed by the FOMC statement and projections and the Federal Funds rate at 7:00pm. It is likely to be a volatile day for this pair.