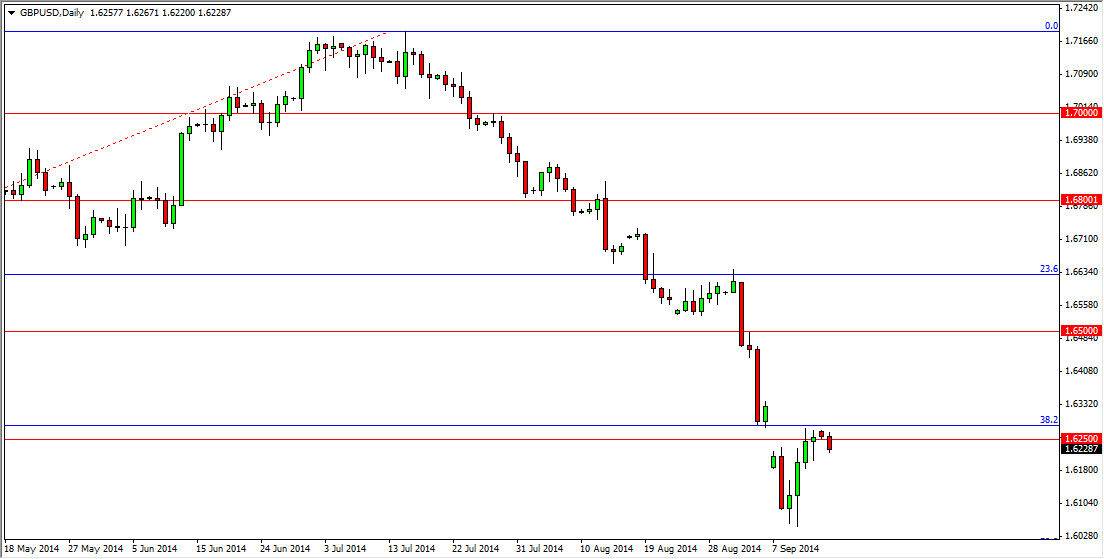

The GBP/USD pair fell during the session on Monday, respecting the gap from earlier last week that formed at the 1.6250 region. This of course suggests that we are going to see a bit of a pullback, at least in the short-term. Ultimately though, I think that this pair is going to bounce much higher especially considering that the weekly candle formed a massive hammer. That hammer of course is a nice buying opportunity if we can break the top of a, which happens to be basically at the 1.63 handle, or the top of this. Move above there suggests that perhaps the so-called “smart money” is starting to buy the British pound again. After all, the Scottish Independence Referendum is coming on Thursday, and as a result we could see a massive change in the value the British pound.

Of course, markets are fairly dramatic.

Marketplaces tend to be fairly dramatic, quite a bit like teenage girls. Quite frankly, I feel that these markets tend to overreact to almost any hints of trouble, and I think that’s what’s happened in the British pound. After all, we have sold off drastically and we haven’t even got the vote yet. Yes, the referendum is going to be fairly close, but at the end of the day unless Scotland leaves, the British pound has been sold off far too stringently. If the Scots choose to stay within the United Kingdom, this market is going to absolutely skyrocket.

I see this is a simple risk to reward ratio question. Yes, we could fall bit from here but I think the 1.60 level is massively supportive. I think it’s more likely that the Scots stay, and as a result quite a bit of the market will find itself “on the wrong foot.” If the Scottish to of course stay within the United Kingdom, we could see a move all the way to the 1.70 level, which of course would be a very strong move. On top of that, I think it would happen very quickly. If I’m wrong, the move lower probably will be too drastic as it will have certainly been somewhat “baked in.”