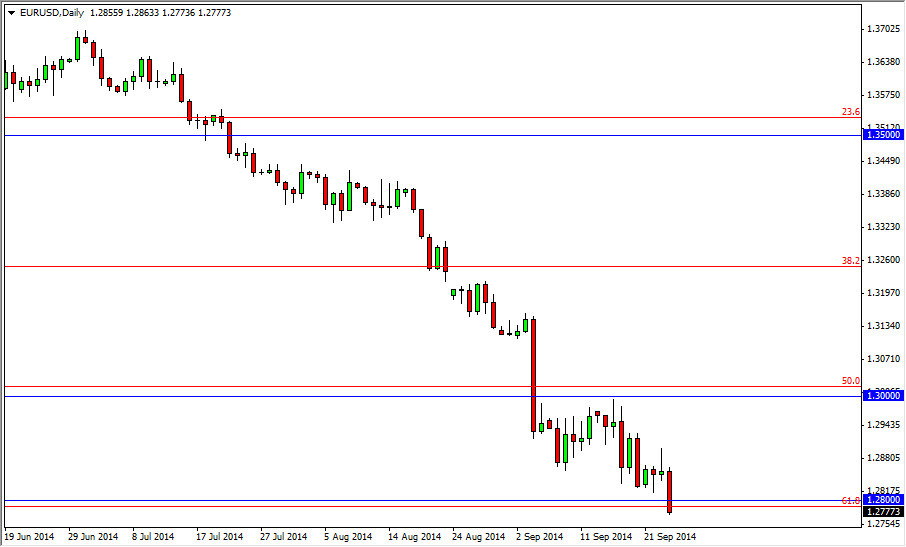

The EUR/USD pair broke hard to the downside during the session on Wednesday, breaking below the 1.28 level, an area that has in fact been rather supportive. However, I am not willing to step into this marketplace to the downside though, simply because it appears that the support runs all the way down to the 1.2750 level. The 1.28 level of course has been supportive in the past, and based upon the fact that the 1.28 level is the 61.8% Fibonacci retracement level from the entire move higher, the market looks like it could in fact be very difficult to break down below this area.

If we break down below the 1.2750 level, and I do think it will happen sooner or later, this pair could drop down drastically. In fact, we could go as low as the 1.20 level given enough time. That’s obviously a longer-term call, but ultimately that could be the target.

Selling rallies as they come.

I’m going to continue selling rallies as they appear, as I believe the downtrend will in fact continue to offer plenty of selling opportunities. However, we could bounce from here and that doesn’t change my opinion whatsoever unless of course we get above the 1.30 handle. In other words, I believe that we should continue to see selling opportunities on short-term charts over and over, and that will be especially true we break down below the 1.2750 level. Ultimately, I think this could be a nice long-term move waiting to happen but we do not have the clearance yet to start risking any serious money.

I think that the European Central Bank is going to be loosening its monetary policy fairly soon, as the market is anticipating. On top of that, the Federal Reserve will continue to tighten its monetary policy via tapering off of quantitative easing, which is essentially the same thing as tightening. With that, the industry differential should start to go back towards the US, and as a result more money will flow into America.