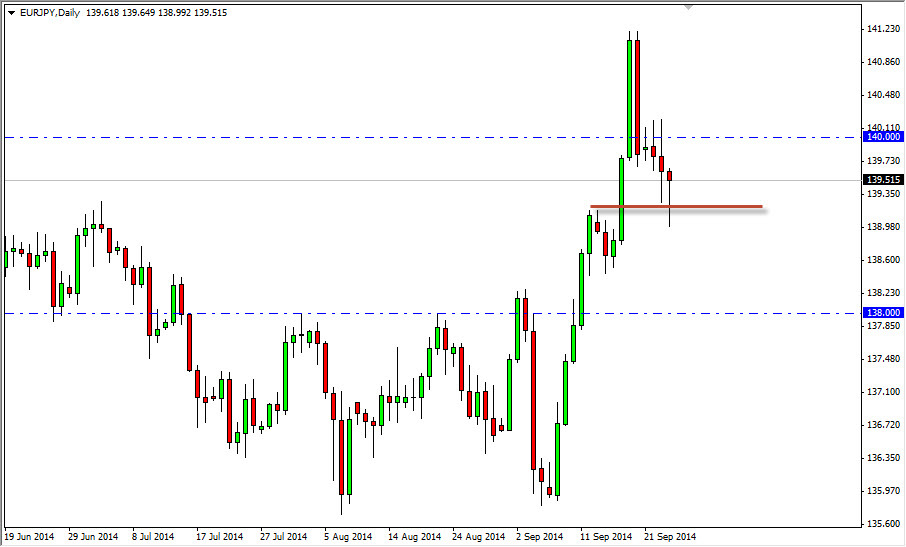

The EUR/JPY pair fell during the course of the day on Wednesday, but as you can see found enough support near the 139 level to turn things back around and form a beautiful looking hammer. This hammer suggests to me that we are in fact starting see more buyers step into the marketplace, and as a result we will eventually see bullish pressure to the upside again. I think that if we can break above the 140 level, this market should continue to go to the 141.50-ish area.

Pullbacks will continue to be buying opportunities as far as I can see, as I anticipate the 138 level as been massively supportive as well. The Euro continues to weaken against most currencies around the world, so the fact that we are starting to see support in this pair tells me that the move is probably more about the Japanese yen than anything else.

Bank of Japan

The Bank of Japan will continue to offer very loose monetary policies going forward, trying to expand the export market. Because of that, I believe that the Japanese yen will continue to sell off against most currencies, and the Euro won’t be any different than some of the other ones. With that being said, I believe that this market is in fact going to head to the 145 level given enough time, and I have no interest in selling this market, probably the single Forex pair right now involving the EUR on the front of the equation that I have no interest in selling.

The sugar the hammer is perfect as far as I can tell, so I really believe that we could get a nice buying opportunity here. In fact, I believe that even if we drift lower from here, looking at short-term charts for hammers in other supportive looking candles is probably going to work out quite well for the buyers. I have no interest in selling this market at this point in time, as not only does the 138 level look supportive, there is a ton of support just below there as well.