By: Ben Myers

Whilst BTC/USD continues to trade in a narrow range, Bitcoin exchange start-up CoinJar announced that it would be trying to bridge the gap between the digital currency and the traditional methods of making payments by introducing smart cards which would allow users to make the payment in Australian dollars backed by the digital currency. This is considered to be a hugely positive development for the Bitcoin. Also in similar developments, Gem, the Bitcoin API developer just announced a first round seed funding for it.

According to many Gem could become a game changer in the coming days and months as the developer would be able to provide clients the much needed security features and integrate many other features into the Bitcoin infrastructure which would allow early adopters and the users of Bitcoin a huge advantage to bridge the gaps between traditional payment structures. The company also is looking at building an all in one Bitcoin platform.

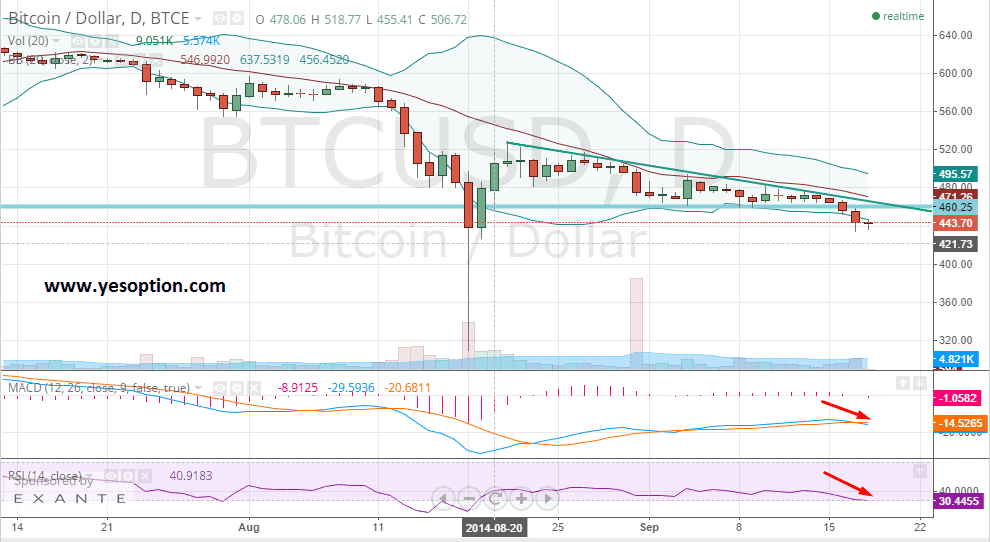

The BTC/USD gave a breakdown in yesterday’s trading session after being in a very narrow trading range over the last week or so. The breakdown was on back of high volumes which is a bearish indicator and shows the momentum shift towards the bearish side. The digital currency broke down from its important support zone at $463 and swiftly moved towards levels around $440 in intraday trading hitting an intermediate of $433. The momentum indicator for the BTC/USD has given a fresh sell signal which is confirmative of the shift in momentum towards the sell side. The relative strength index has also given a fresh sell signal which is indicative of the selling pressure. It is imperative to know that the digital currency currently trades below all of its important daily moving averages.

Actionable Insight:

Short BTC/USD at current levels for an intermediate target of $380 in the near term with a strict stop loss above $462