By: Ben Myers

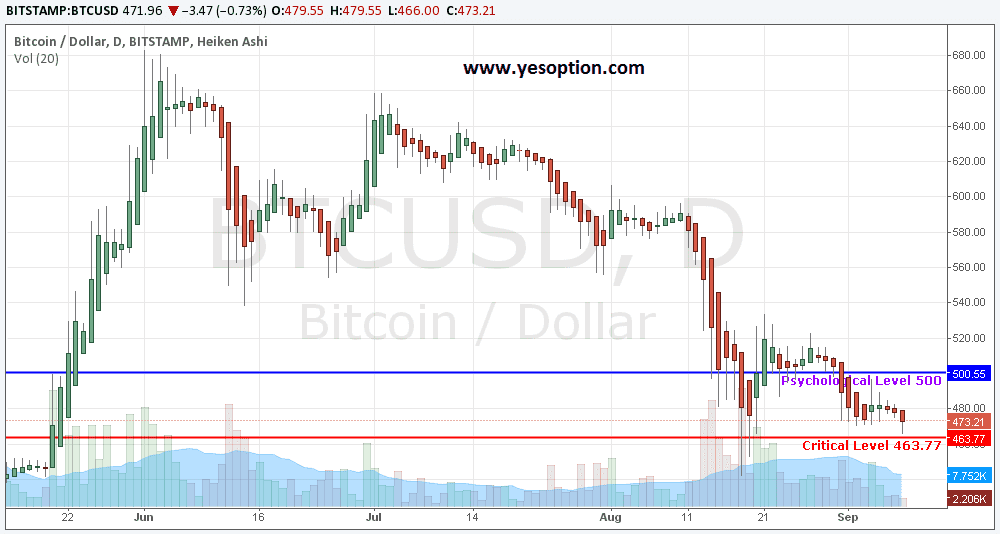

BTC/USD continues to trade down and in a narrow range. It is currently trading in a very narrow range of $466 to $483 with immediate support pegged at $463.77 and resistance at $500 levels which is also psychological level which traders would be watching. The volume for cryptocurrency have been very low which is a cause of concern. Traders would be looking to buy BTC/USD on every dip with stoploss of $455 in short term.

Bitcoin is certainly making progress and this could be well witnessed from a number of companies vying to set up their bitcoin ATMs. One such ATM has just been veiled off by PYC at New York, which lets the users transact real cash for bitcoins. As of now, the ATM does not convert the cryptocurrency into cash, but if bitcoin propellers are to be believed, the ATM is in itself a milestone achievement and could spur the activity for bitcoin to come into the mainstream.

While bitcoin ATMs are trying to woo new customers, one of the online payroll processing company, Wagepoint, is reporting a sharp increase in interest of companies in paying salaries through bitcoins. Wagepoint caters to the Canada and US based companies and said that initially, when it started the payment option in November and December, they found no response, however, starting January they started the customers turning up and apparently they have processed $75,000 of bitcoins in salaries so far.

Meanwhile, a company specializing in mining bitcoins, KnCMiner has garnered $14 million funding through Nordic VC firm Creandum. The successful raising of the fund has placed the firm in line of the other companies like Bipay, Coinbase and Xapo, which have raised more than $10 million of financing so far. KnCMiner specializes in making computers for bitcoin mining and want to move further into cloud computing service. Since its launch less than two years ago, the company has earned a total revenue of nearly $110 million.