The XAU/USD pair (Gold vs. the American Dollar) closed higher than opening for a third consecutive day as investors moved to the safety of gold after flaring Ukraine tensions ruined investors' appetite for riskier assets. Ukrainian President Petro Poroshenko said Russian troops are helping separatists and directly engaged in fighting. The White House said President Barack Obama and German Chancellor Angela Merkel agreed that the US and EU should consider more sanctions on Russia. The XAU/USD pair traded as high as $1296.39 an ounce but pared gains after the second reading of GDP showed the world's biggest economy expanded more than initially thought in the second quarter and the National Association of Realtors reported that sales of previously owned homes rose more than forecasts.

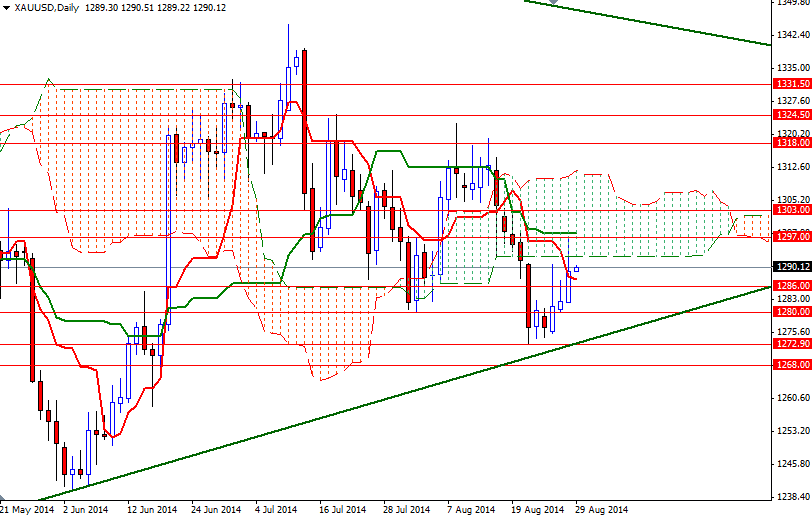

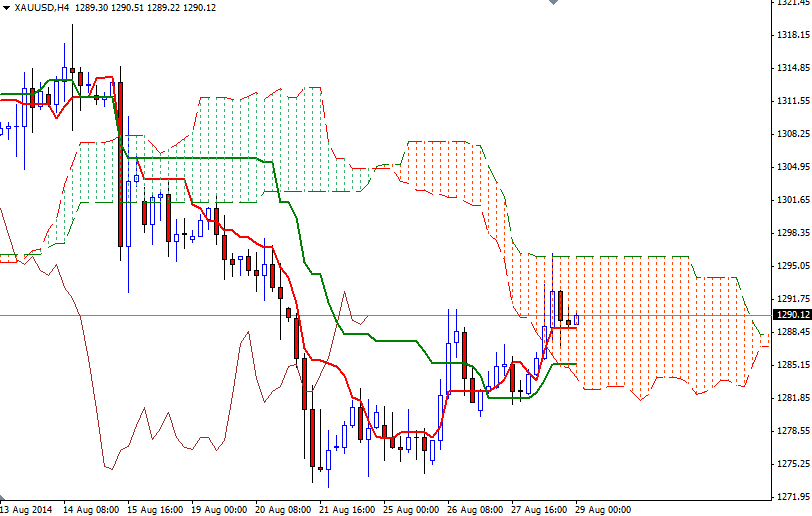

In my previous analysis, I had pointed out that the shorter-term charts were bullish (suggesting higher prices) and the 1286 level was the key for that. However, also noted that there was strong resistance at the 1296.05 level where the top of the Ichimoku cloud sits on the 4-hour time frame. Today, the XAU/USD pair is currently moving inside the cloud and because of that I will keep an eye on this territory.

If the bulls manage to hold prices above the 1286/5.40 support, they might find another chance to test the 1296.05 resistance. But in order to do that, they will have to break though 1292.70 which happens to be the bottom of the daily cloud. Only a close above the 1297/.75 area could provide the bulls extra fuel they need to reach the next barrier at 1303. On the other hand, if the bears take the reins and drag the market below the 1286/5.40 support, the XAU/USD pair may head back to the 1282/0 zone. Breaking below this support would indicate that the bears are getting ready to challenge the bulls on the 1274/2.90 battlefield.