Although gold gained some ground against the American dollar on Tuesday, solid economic numbers out of the United States hindered the bulls' advance. The pair initially climbed to a 4-day high of $1291.09 but pulled back to the $1280 level after data releases. The Conference Board’s consumer confidence index came in stronger than expected with a print of 92.4 and the Commerce Department reported that orders for durable goods jumped 22.6% in July.

Aside from economic reports, investors also focus on geopolitical tensions because these events generally drive gold prices higher. Yesterday, Israel and Hamas agreed on a long-term truce. Russian and Ukrainian presidents held their first direct talks on the conflict in eastern Ukraine. President Putin said at that "Russia, for its part, will do everything to support this peace process if it starts" but he also underlined that it was up to separatist leaders and Ukrainian officials to come up with a truce plan. Although Kremlin denies supporting the rebels, the US and EU imposed sanctions on Russia.

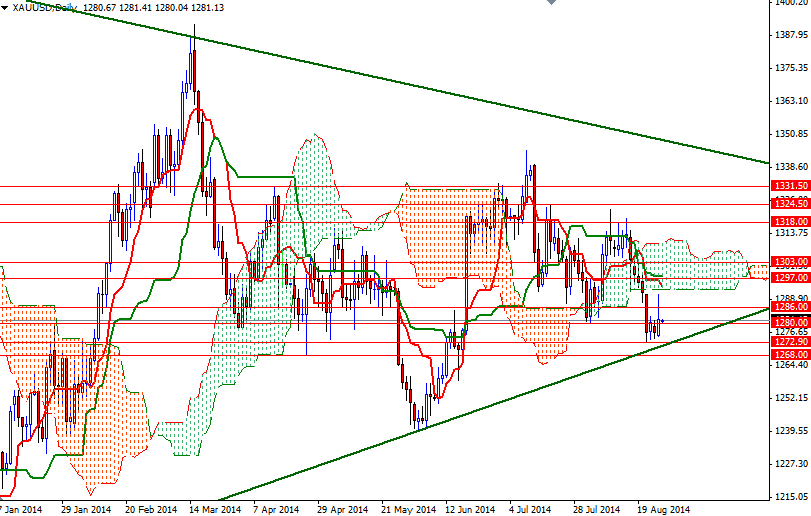

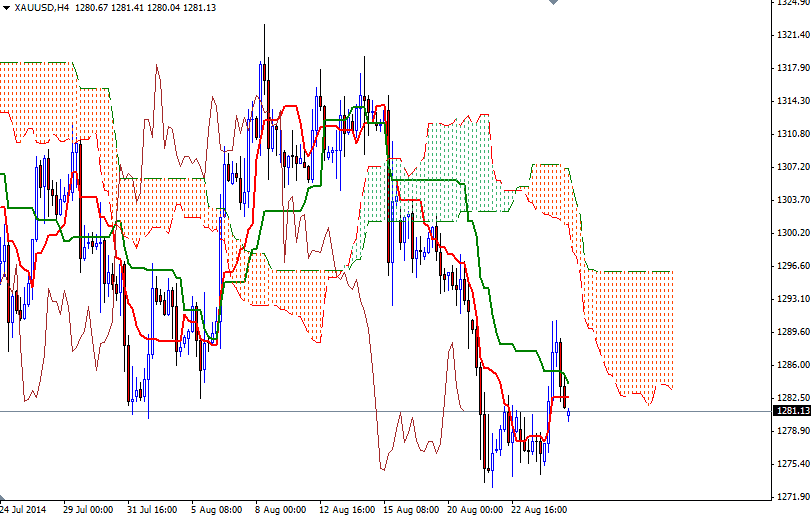

Yesterday's price action shows that the bulls won't give up without a fight. As I mentioned in my previous analysis, the XAU/USD pair has seen some support just above the 1292.70 - 1268 area. Today, I will keep an eye the 1280 and 1286 levels. 1-hour chart is slightly bullish at the moment but in order to expand their territory, the bulls will have to climb above the 1286 resistance level. If that is the case, it is technically possible to see the market tackling the next barrier at 1292.70. On the daily time frame, Ichimoku clouds currently cover the area between 1292.70 and 1312. Therefore encountering selling pressure wouldn't be surprising. To the down side, support can be found at 1280, 1272.90 and 1268. A daily close below the 1268 level would make me think that the market is heading to the 1240 support level.