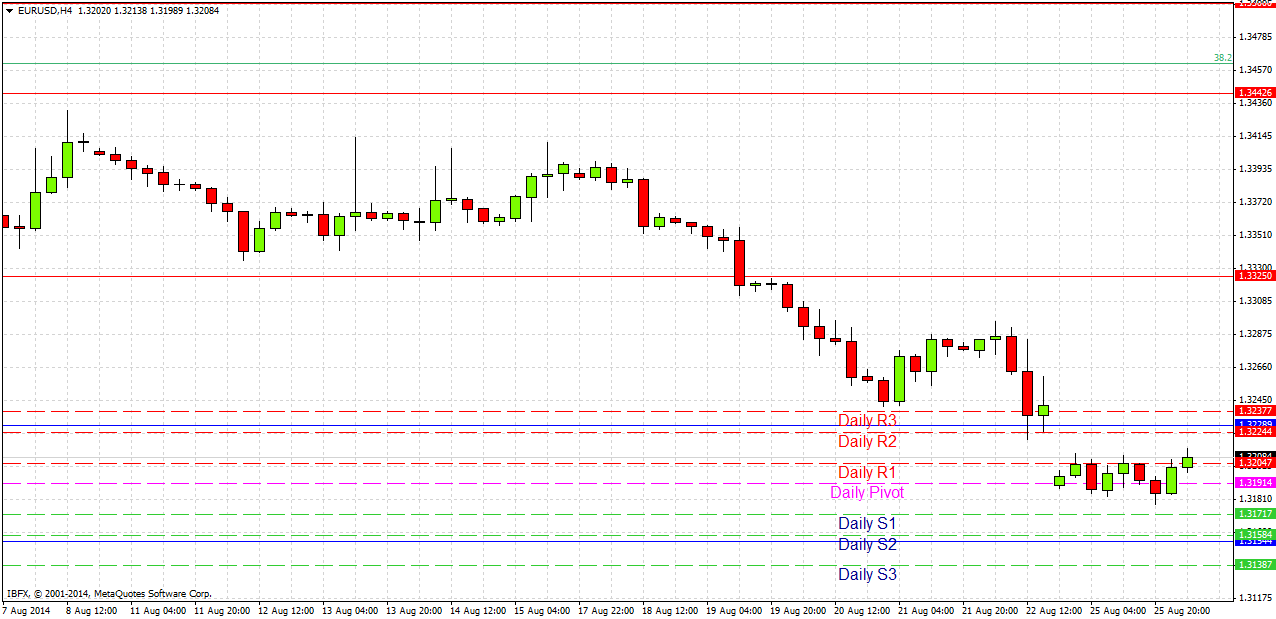

EUR/USD Signal Update

Last Thursday’s signals were not triggered and expired at the end of that day’s London session.

Today’s EUR/USD Signals

Risk 0.75% equity.

Entries before 5pm London time today only.

Long Trade

Go long following bullish price action on the H1 time frame after the first touch of 1.3155.

Place a stop loss 1 pip below the local swing low.

Move the stop loss to break even when the price reaches 1.3220.

Take off 75% of the position as profit at 1.3220 and leave the remainder to run.

Short Trade 1

Go short following bearish price action on the H1 time frame after the first touch of 1.3325.

Place a stop loss 1 pip above the local swing high.

Move the stop loss to break even when the price reaches 1.3325.

Take off 50% of the position as profit at 1.3260 and leave the remainder of the position to run.

Short Trade 2

Go short following a strong lower high after the price exceeds 1.3296.

Place a stop loss 1 pip above the local swing high.

Take off 75% of the position when profit is twice risk and leave the remainder to run.

EUR/USD Analysis

The strong downwards trend has continued. The USD is very strong and EUR is very weak and that has obviously resulted in this pair falling sharply.

Yesterday was a public holiday in the U.K. so was fairly quiet. It is notable that the support at 1.3229 did hold when it was touched on Friday, and not surprising that the banks managed their usual trick of getting the price to gap down below such support over the weekend. At the time of writing, the gap has not yet been filled, but is this is quite likely to happen today.

It currently looks like the best trade will be waiting at a pullback to around the 1.3300 – 1.3325 area, from which the price is quite likely to fall again.

My colleague Christopher Lewis is thinking the same way. However I see the first potential support a little earlier than he does, at 1.3155.

There are no high-impact data releases due today concerning the EUR. Regarding the USD, at 1:30pm London time there will be a release of Core Durable Goods data, followed by CB Consumer Confidence at 3pm, both of which are likely to affect the USD. This pair is likely to be more active during the New York session.