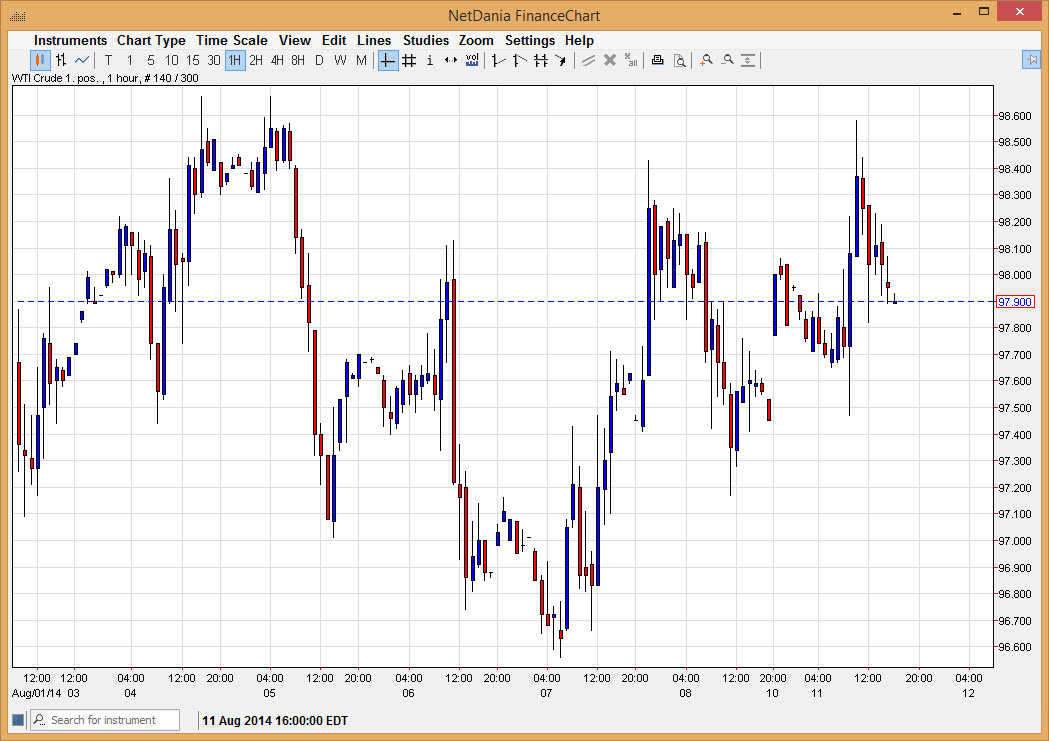

The WTI Crude Oil markets fell during the open on Monday as we gapped lower and just sat there. Essentially, the market has absolutely nothing driving it at the moment, as we continue to consolidate and a very choppy area of the charts. The market has been choppy overall anyways as the move higher keeps getting an impulsive moves lower accompanying it. Because of this, I have been one to basically stay away from this market, but I do think that perhaps binary options might be one way to play the volatility in this contract.

Certainly, it’s going to be almost impossible to trade this market in the futures pits because of the volatility and a large amount of margin needed. With that, I find this a market that is much more suited for the CFD market or options. After all, in a marketplace that has no real perceivable driver in one direction or the other, you need to keep your risk under control. It’s difficult to imagine being able to handle the volatility for any length of time though, so I think that if you are thinking about playing this for the longer-term move, options have to be probably the safest route to go, simply because you can know your risk at a time, which of course is going to be vital in a market that could jump in one direction or the other.

Watch the US dollar.

Watch the value of the US dollar in general, as the oil markets are greatly influenced by the value of the currency, as it is obviously traded in Dollars. With that, the fact that the US dollar’s strength should continue to go higher, it’s very likely that the oil markets will continue to struggle to go in one direction or the other as even though we could get more demand for the commodity, the currency markets will work against a higher oil market. Nonetheless, I believe that we will ultimately go higher, but longer-term options will probably be the only way I can play this market.