By: Ben Myers

Bitcoin looks set to mark the third consecutive weekly loss. During the course of the week, the digital currency took support from the fundamental and technical support region of 540-550 and bounced from the oversold level of 555.90 to a high of 607.20. BTC/USD has since then fatigued and slipped sharply from the near-resistance levels to a current value of $581.21. It must be noted that the digital currency rose sharply on the news of the controversial Argentina debt default but has calmed down post the event. Bitcoin is now equidistant from the major resistance and major support levels of 610 and 550 respectively.

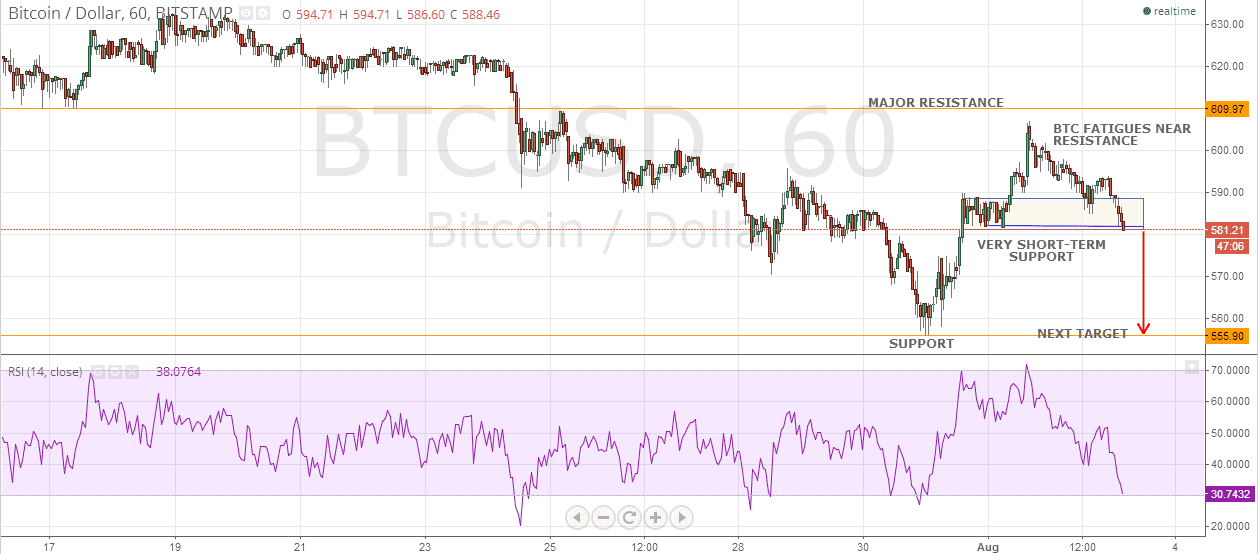

As can be seen from the BTC/USD hourly chart above, the currency is poised to make a big move in either direction in the coming trading sessions. Bitcoin is placed at the very short-term support level of 580, a close below which may take the currency down to its previous low of 555. On a contrary note, if the currency manages to hold its ground at current level, it can be safely assumed that the selling has been abated and some long positions can be built in this counter.

The current scenario does not provide good risk/reward opportunities and hence, traders should adopt a wait and watch strategy to enter a trade at lucrative levels. Long positions can be built near 550-560 levels for a target of 590 by placing a closing basis stop-loss just below 540. Short positions can be added near the major resistance at around 605-610 for a target of 580 by placing a closing basis stop-loss north of 610.

A grassroots initiative aimed at promoting the use of digital currencies in Latin America, a project named PropinaBitcoin, has been launched which allows Bitcoin users to give tips in restaurants by printing paper wallets. In another instance, UK’s major charity, The Royal National Lifeboat Institution, has announced that it is now testing Bitcoin in donations.