By: Ben Myers

In the last 24 hours, Bitcoin prices has hit new volatility levels unseen for a while, recording a drop of more than 3% to test levels as low as $570, before recouping marginally. However, the sharp drop could not be connected to any specific incident as such; rather, it's a part of broader market movement in the virtual currency space.

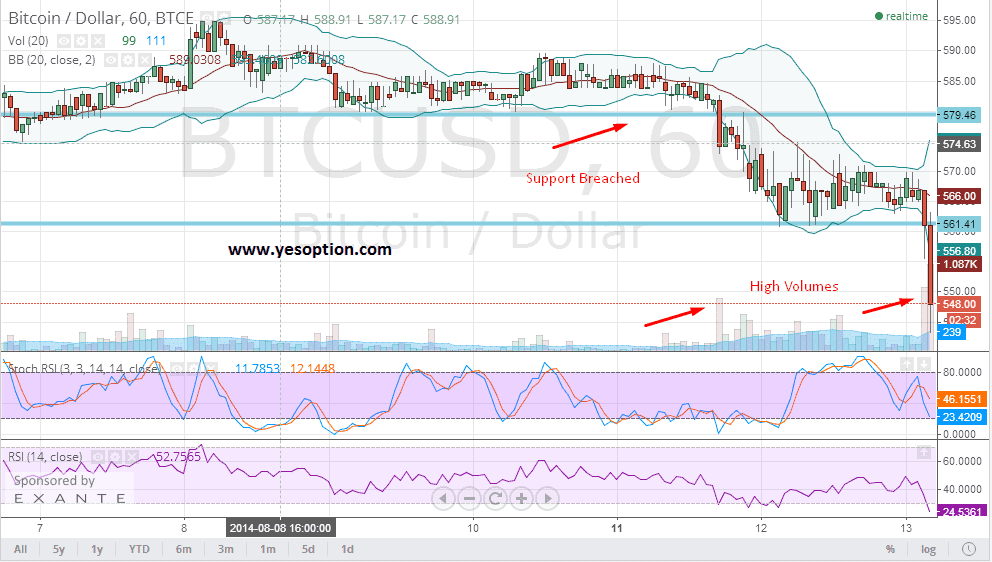

BTC/USD on the hourly charts broke below the key support level of $580 on above average volumes which are a bearish sign. Aforementioned support was closely monitored by traders over past few trading sessions. The digital currency post the breach of the support level witnessed sustained selling pressure and every rally was being used to short the market by the bears. BTC/USD closed below its 20 day EMA and breached the lower end of the Bollinger band.

The stochastic oscillator for the BTC/USD on the hourly charts has formed a lower high which is a sign of divergence and looking at the high volumes momentum might have shifted towards the bearish side.

Traders can go short on the BTC/USD with a strict stop loss at $565 with a short term target of $537.

JP Morgan does not fear the volatile nature of the virtual currency as it is engrossed in its own business of developing a new method for internet payment processing via the electronic funds transfer, a system that would duplicate some of the features of bitcoin, but JP Morgan's endeavors are upsetting the bitcoin supporters.

Nevertheless, Bitcoin fans should get relief from the latest progress, which is that BitGo has found new customer in the Bitcoin Foundation. The company has elected to adopt BitGo's Enterprise product to handle its financial operations going ahead. BitGo considers the deal as another milestone that would help pave the way and propel bitcoin for increased institutional adoption.

Contrary to these developments, the U.S. Consumer Financial Protection Bureau has raised an alarm over the risks involved in bitcoin operations. The agency reiterated that the virtual currency is not backed by any legal framework, which makes it prone to hacking and other potential risks like Ponzi schemes and scams. Further, CFPB Director Richard Cordray said that the cost of Bitcoin transactions are actually on the higher end as against the tradition credit cards and cash, and therefore, should be ventured in with utmost caution.