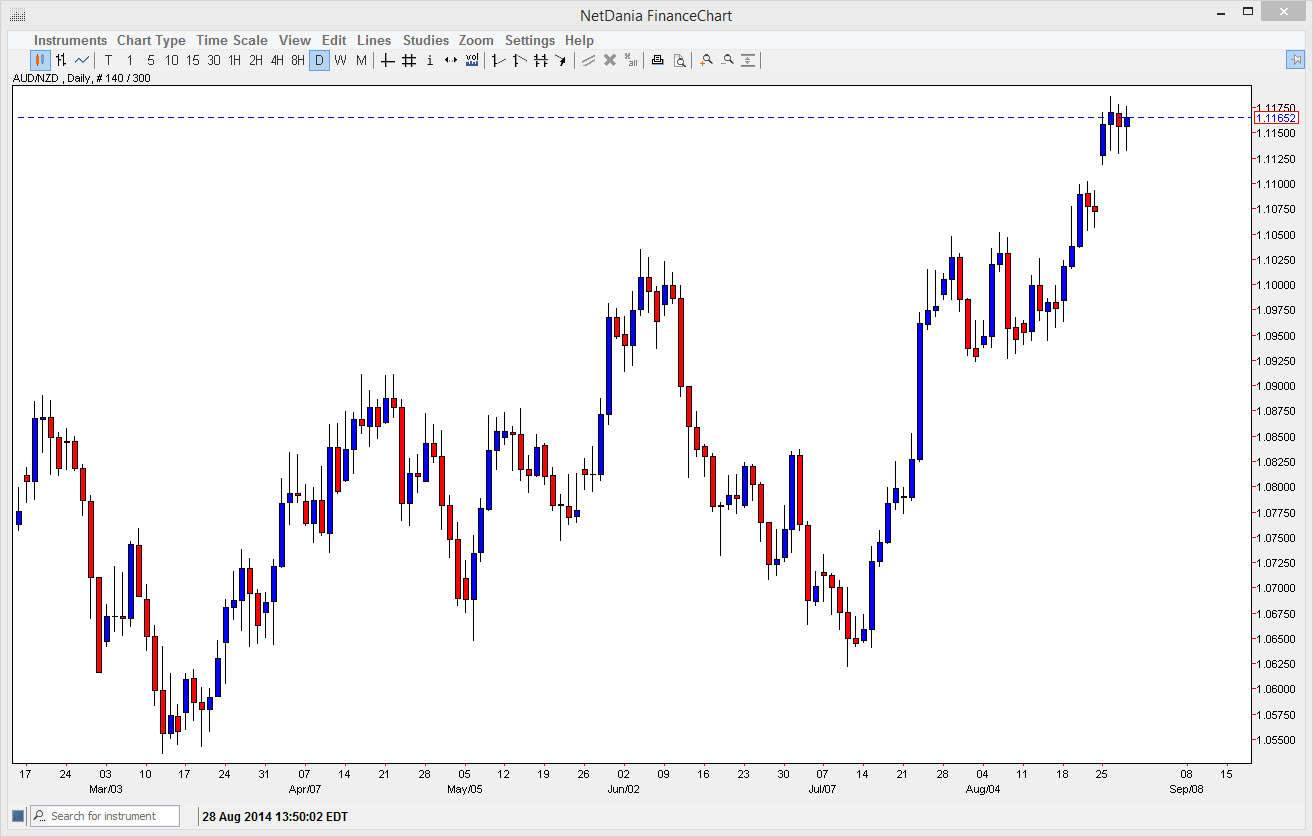

The AUD/NZD pair has done the same thing for the last three days: form hammers. This is after gapping higher at the open of the week, so I believe it’s only a matter of time before this pair breaks out. Quite frankly, the New Zealand dollar versus the US dollar looks absolutely horrible, while the Australian dollar versus the US dollar is still above support. I don’t know that the Australian dollar is simply going to be the currency to own overall, but it certainly seems to be better off than the New Zealand dollar, and in this market that’s all that matters.

The gap below should continue to offer support as per usual, and I believe that the 1.11 level is of course massively supportive because of it. I think that pullbacks will continue to offer buying opportunities, but considering that we are in the last week of August, it’s likely that there just simply isn’t enough in the way of liquidity to get this market moving. With that in mind, I feel that you will have to be fairly patient owning this pair, but I think ultimately we will probably go as high as 1.15 given enough time.

1.10 is also a major support area.

I believe that the 1.10 level is going to continue to be supportive as well, and as a result even if we break down below the 1.11 level, I think there are plenty of buyers below. It is not until we clear the 1.09 handle that I feel comfortable selling as we would reenter a larger consolidation area, but quite frankly I do not see that happening without the NZD/USD pair breaking back above the 0.85 handle, something that looks very unlikely considering that there was a massive shooting star in that marketplace for the Thursday session. The New Zealand dollar looks like it’s ready to continue falling against the US dollar, and then by extension due to the fact that it is not as bad off as the Kiwi dollar, the Aussie dollar as well.