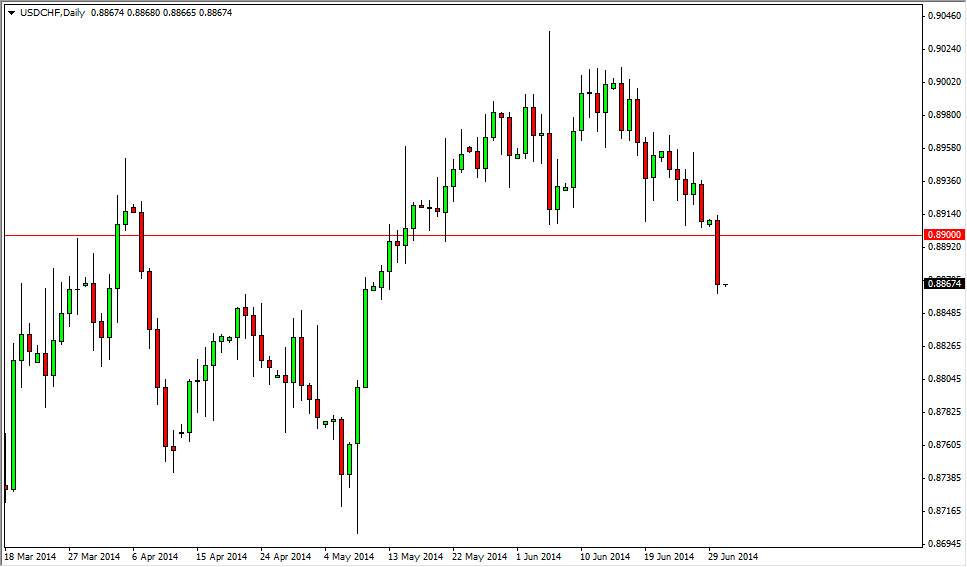

The USD/CHF pair broke down during the day on Monday, smashing through the 0.89 handle. That level course has been very supportive, but the fact that it gave way during the session on Monday suggests that the market is ready to continue falling. What’s interesting to me is that the pair tends to move inversely to the EUR/USD pair, and that pair looks as if it is ready to start breaking out. If we can break out above the 1.3750 level in the EUR/USD, I think that this pair will fall significantly.

On top of that, the US dollar in general is starting to get beat up, and as a result I think it makes sense that this pair continues to fall. The US dollar is not as much of a “safety currency” as the Swiss franc, so this shows that there must be some type of significant fear out there.

Longer-term downtrend should continue at this rate.

I believe that the market should continue to fall over the longer term at this rate, and that any bounce from this area will more than likely find a significant amount of resistance near the 0.89 level as “what was once the floor becomes the ceiling” as is the old adage that technical analysts use. With that, I would be very interested in selling a resistant candle near the 0.89 handle, or I do consider selling this market on a break of the lows for the session on Monday.

Is not until we break above the 0.8950 level that we would consider buying this market. At that point in time, we would more than likely head back to the 0.90 level first, and a break of that area to the upside would in fact be very bullish as well. Going forward, this is one of those markets that might be off the radar of most traders, but they will simply be missing out on what could be one of the clear ways to play the US dollar in the next few weeks.