USD/JPY Signal Update

Yesterday’s signals were not triggered as the price never reached either 100.88 or 102.22.

Today’s USD/JPY Signal

• Entries may only be made before 5pm London time today, and then during the following Tokyo session.

• Risk 0.75% of equity.

Long Trade 1

• Go long following bullish price action on the H1 time frame after the first touch of 100.88.

• Put a stop loss 1 pip below the local swing low.

• Move the stop loss to break even when the price reaches 101.25.

• Take off 50% of the position as profit at 101.65 and leave the remainder of the position to run.

Short Trade 1

• Go short following bullish price action on the H1 time frame after the first touch of 102.22.

• Put a stop loss 1 pip above the local swing high.

• Move the stop loss to break even when the price reaches 101.86.

• Take off 50% of the position as profit at 101.86 and leave the remainder of the position to run.

USD/JPY Analysis

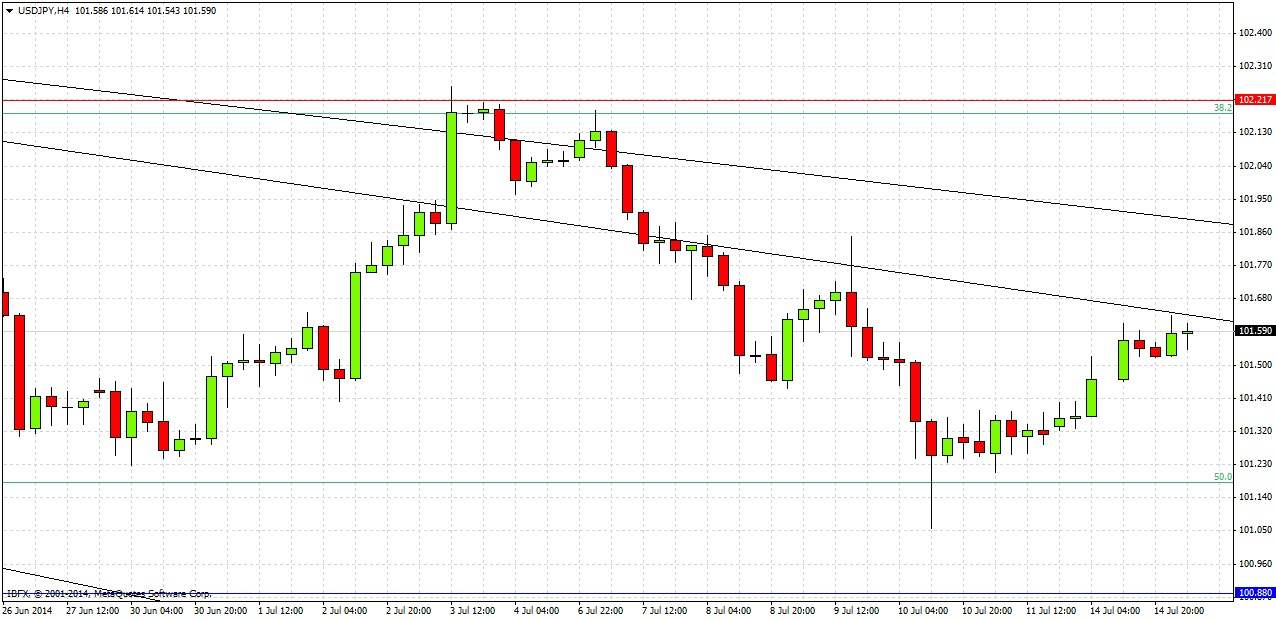

For more than one month we have been stuck in a range between 102.22 and 100.88 or thereabouts. This has been a hard pair to trade but the resistance and support at these two levels still seems to provide likely trading opportunities at which to catch reversals.

We did move down from just below 102.22 at the start of last week, but we only got as low as the 50% Fibonacci retracement of the major upwards move last year. This line at about 101.18 has acted as nice support over the past few days and seems to have been enough to turn the price around. The action now looks quite bullish.

I have left two old bearish trend lines on the chart as although they were broken it still seems they might have some influence. If the fast move up this morning continues, either of them might pause or halt it.

There are no high-impact news releases due today concerning the JPY. Later at 1:30pm London time there will be a release of US Retail Sales and Core Retail Sales data, and then at 3pm the Chair of the Fed will be testifying. Therefore today’s New York session is likely to see the most activity in this pair.