The NZD/USD pair fell during the day on Thursday, as the reaction to the Reserve Bank of New Zealand and its rate increase was fairly muted. After all, the statement that accompanied the rate decision suggested that perhaps housing was cooling and New Zealand, and that of course could lead to a less than aggressive tightening cycle. Nonetheless, I do believe that the selloff is a bit overdone, and with that I feel that the market will ultimately find a way to bounce.

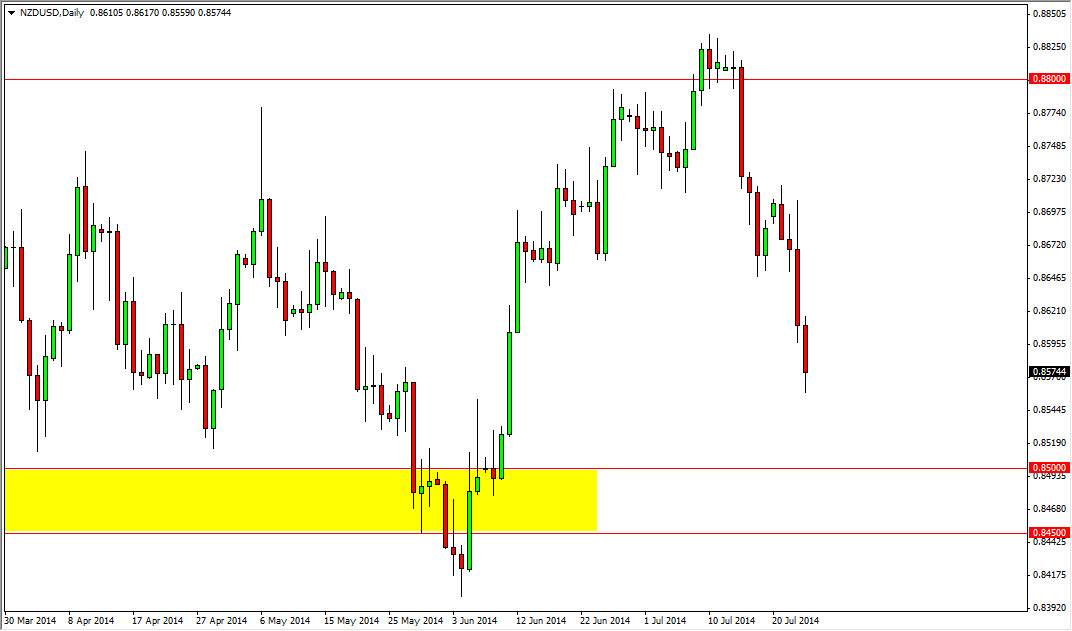

For me, I see that the 0.85 level is very supportive, and as a result I’m actually looking for some type of supportive candle in that general vicinity in order to start buying again. I believe that the region goes all the way down to the 0.8450 level at the very least, so I would expect buyers to step in at that point.

Overdone, and that could be an opportunity.

I believe that the selloff has been overdone, and that any type of support near the 0.85 level is probably going to be a decent buying opportunity. That should send the market looking for the 0.88 handle, which of course is massively resistant. We have to get above that area in order to head to the 0.90 handle, which is my longer-term target. The New Zealand dollar typically is very volatile overall, so this massive selloff really isn’t that big of a surprise.

I believe that we will finally break out sometime later this summer, or perhaps once the fall season starts, as traders the macro holiday. Nonetheless, I am not interested in shorting this market unless we get below the 0.84 handle, which would show a complete smashing of support, and thereby making me believe that the trend is falling apart for the buyers, and that we will see quite a bit of creative destruction. However, I really don’t think that we are going to break down below that area, so therefore I am simply looking for an opportunity to take advantage of a cheap Kiwi dollar.