The XAU/USD pair (Gold vs. the American dollar) scored a gain of 1.1% on Thursday as heightened risk aversion and disappointing economic data out of the world's largest economy (on the housing front) combined to provide support to the precious metal. Also increased volatility in the major stock markets triggered some safe-haven buying that helped underpin gold. Geopolitical concerns returned to the forefront after tensions in Israel and Gaza escalated overnight, and a passenger jet was shot down over eastern Ukraine. The Commerce Department's report showed that building permits decreased 4.2% to a seasonally adjusted annual rate of 963K in June and housing starts fell 9.3% to 893K.

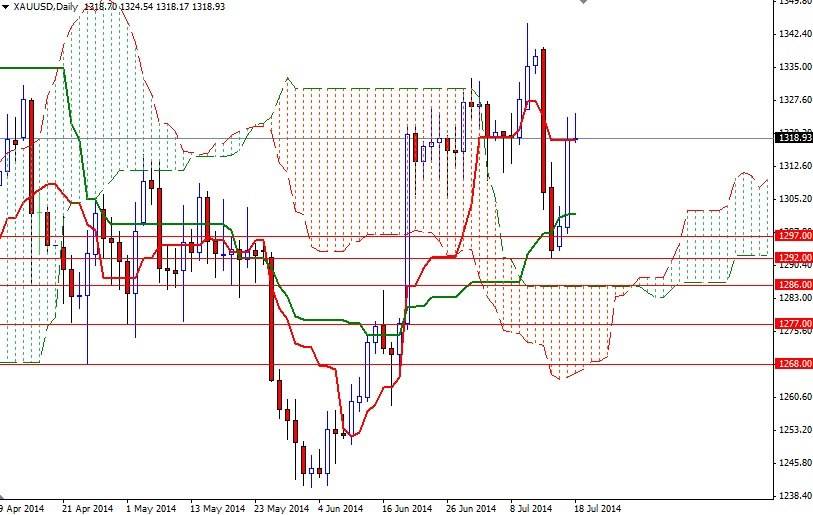

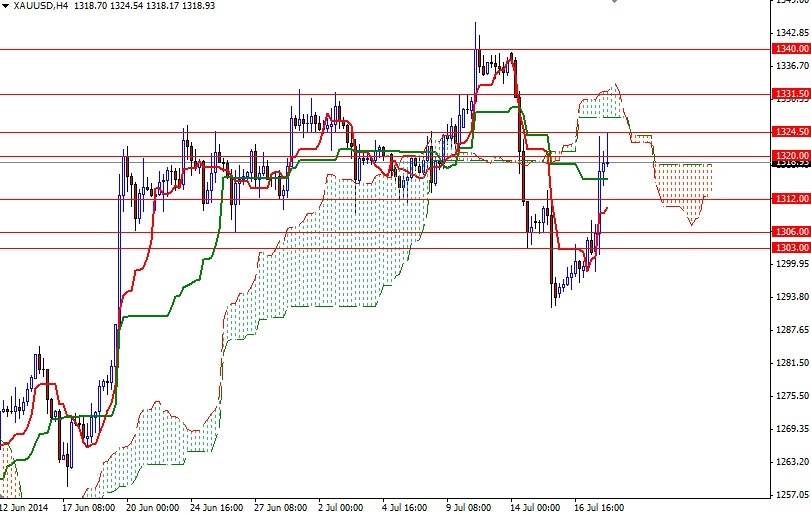

Although the concerns over the Middle East and Ukraine are likely to keep a floor under the market, there are some tough resistance levels ahead such as 1320, 1324.50 and 1351. The markets have been vulnerable to any escalation in global tensions lately. However, demand for protection against volatility (i.e. appetite for gold) caused by the geopolitical worries has been temporary and failed to ignite an uptrend and I think that is something not to ignore.

There are various variables affecting the gold market these days and because of that I will be paying more attention to the technical levels. Today, I will be watching the area between 1324.50 and 1312. In order to gain more traction and revisit the 1324.50 resistance level, the bulls will have to defend their new camp (1312) and push prices successfully above 1320.

A daily close above 1324.50 would make me think that the 1331.50 level will be the next possible target. To the down side, there is an interim support at 1314.50. That means the bears will need to capture that point before they can reach 1312. If the bears manage to clear this support, prices could retrace back to the 1306 level.