The XAUUSD pair had a positive day as weakness in the U.S. dollar increased investors’ appetite for gold and pushed prices for the precious metal to their highest close in fourteen weeks. Geopolitical concerns returned to the forefront after Ukraine ended a cease-fire with separatists and Iraq intensified an offensive to recapture Tikrit. Yesterday, data from the world’s largest economy were mixed. Chicago purchasing managers’ index came in weaker than expected with a print of 62.6 but the National Association of Realtors reported that pending home sales climbed 6.1% in May.

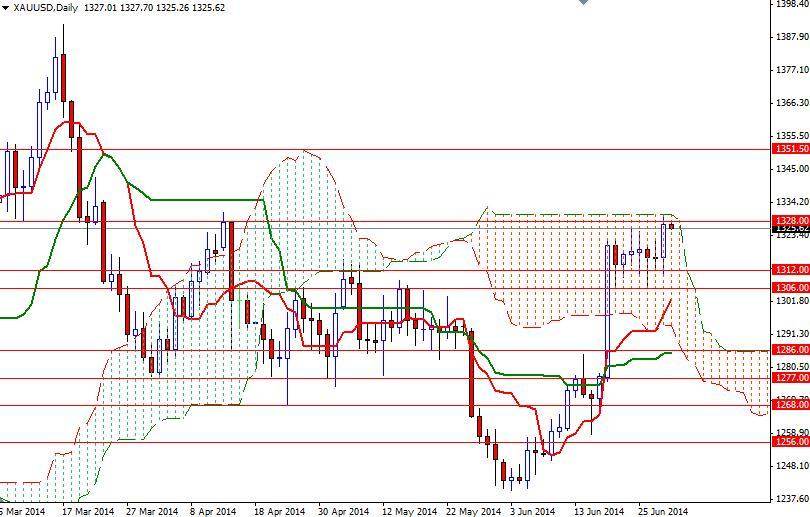

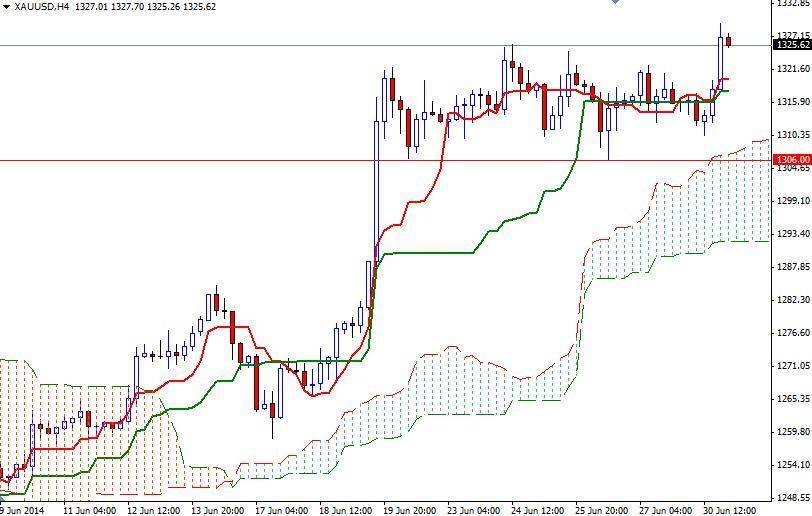

The pair touched the top of the Ichimoku cloud before pulling back to $1325.62 an ounce. Trading above the Ichimoku clouds on the 4-hour time frame is favoring the bulls at the moment. We also have bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-day moving average, green line) crosses. This area between the 1328 and 1331 levels has been resistive in the past so capturing this strategic point is essential if the bulls want to charge towards the 1352 level. If that is the case, look for 1334 and 1340.

From a technical point of view, I still consider the 1312/06 zone as a critical support for the bulls. That means if prices can’t break through 1328/31, we might return to this area. But before that, expect to see some support around the 1320 level. A slew of key economic indicators will be released this week including ADP non-farm employment change, ISM manufacturing PMI and trade balance but of course the highlight of the week will come on Thursday when the Labor Department releases its employment report for June.