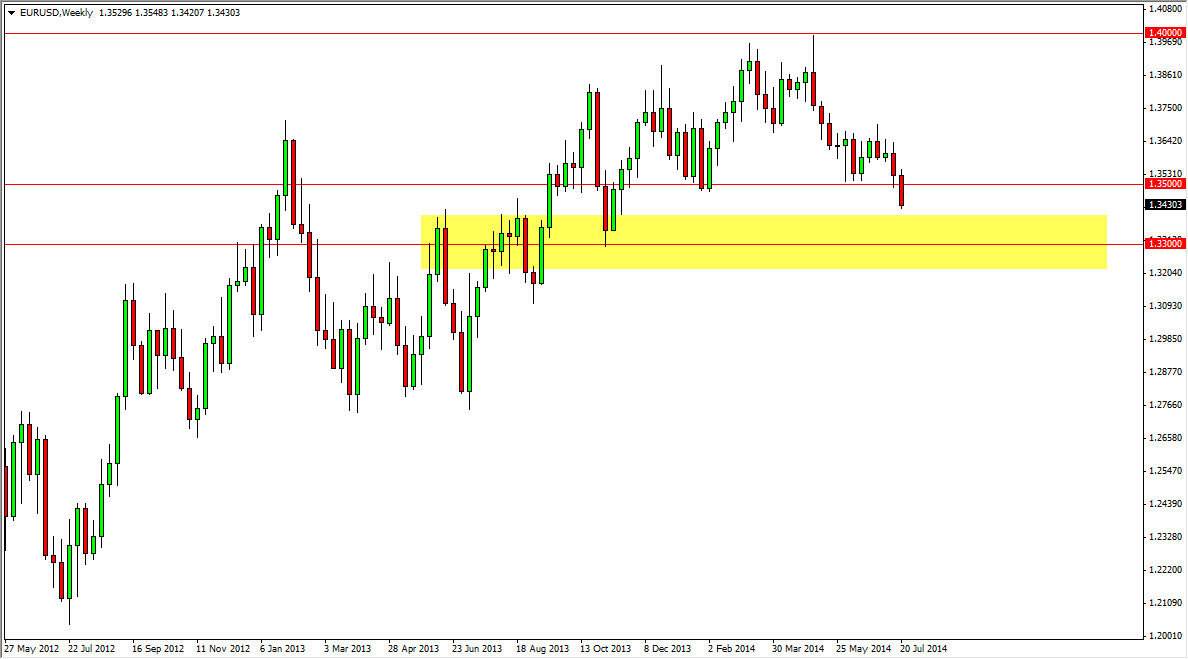

The EUR/USD pair finally broke down below the 1.35 handle during the month of July, which is an area that has been massively supportive or several months. Because of this, I feel that this market probably have a little bit more to the downside in it, and possibly quite a bit more. I think that right now it’s a bit early to trying to garner exactly what will happen, but it’s certainly not looking good for the buyers.

Having said that, if I had a dollar for every time I lost money betting against the Euro, I wouldn’t need to be writing this article. Quite frankly, it seems that every time the Euro is “done for”, something happens to turn the tide back in its favor, and we suddenly go higher.

Trend seems to be broken, but I see plenty of support.

The trend at this moment time seems to be broken, but I see that there is plenty of support below. I think the first significant area will be the 1.33 level, and I do in fact think that we will test that area during the month of August. The real question is what would happen next, as I could see this market going down to the 1.30 level given enough time. After that, we could be talking as low as 1.27 or so, but I really think something negative is going to have to happen in the meantime in order to see that come to fruition. It would almost have to be a bit of a “risk off” type of event, because at this point in time neither one of the central banks seem overly hawkish. Yes, I know that the Federal Reserve has cut back on some of his quantitative easing, but Janet Yellen has recently stated that reserve will have to remain somewhat accommodative even after a recovery in the economy. With that, I feel that the US dollar might be strong in some currencies, but with the European Central Bank and its long-running tradition of underwhelming the markets when it comes to quantitative easing, I think that were probably going to have a slow drift lower, and nothing more than that.