The EUR/HUF market is one that very few of you will play. However, that is not to say that it is not viable. In fact, I really like this pair as far as exotic markets are concerned, simply because it is a reflection on risk appetite more than anything else. After all, the Hungarian forint isn’t exactly a currency that’s traded very often by most of you. As such, is considered to be a “risk currency”, and as a result it will go higher or lower based upon the risk appetitive traders around the world.

Remember, it wasn’t that long ago that the world was concerned about Hungarian debt. With that, this is seen as a “gateway currency” to the Eastern European region, as there has been quite a bit of investment in Hungary. This tells us that the pair is essentially between one of the more stable currencies in the world, with a very risky one on the other side of the equation.

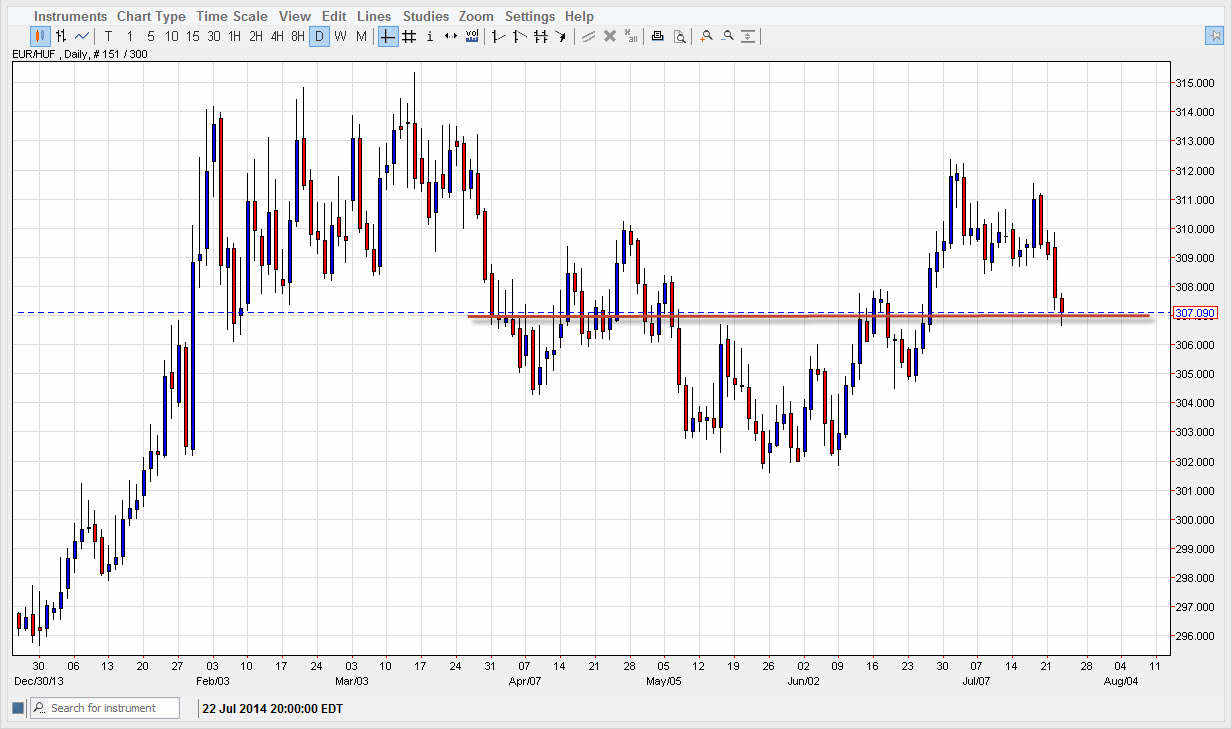

Hammer.

This pair formed a hammer at the 307 level, which is an area that has been of interest to both the buyers and sellers for several months now. With that being the case, I feel that this market will more than likely bounce from here, and this is only further exacerbated by the fact that I see hammers in the EUR/JPY, EUR/USD, and the EUR/GBP pairs. Because of this, I feel that the Euro in general is going to get a bit of a boost, and as a result this lines up fairly well with the other Eurocentric pairs.

The bounce could easily go to the 309 level, if not the 311 area. The market will more than likely reach that area and the next couple of sessions, so that tells us that the market could be ready to go as soon as we break the top of the candle. On the other hand, if we fall from here it would in fact be very negative, but ultimately I see far too much in the way of support all the way down to the 305 level to feel comfortable shorting.

If you do not have this pair available, for it on the Internet as it would show you whether or not investors in Europe have some type of risk appetite issues, or if they are ready to invest in some of the so-called “riskier markets.”