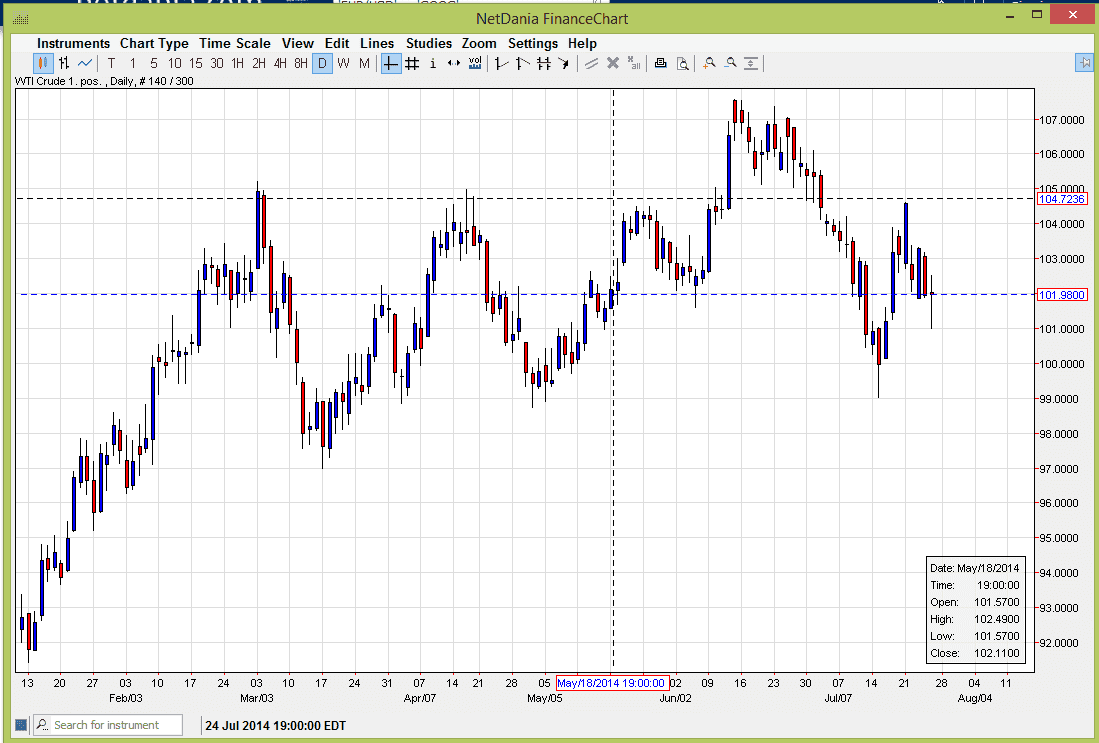

The WTI Crude Oil markets fell initially during the session on Friday, but found in support of the $101 level to turn things back around. With that being said, we ended up forming a hammer, which of course is a very positive sign. With that hammer, it looks to me like the $101 level will be a bit of floor in this market, but ultimately I believe that the trend will continue in its choppy manner that we’ve seen over the last several months. On a break in the top of this hammer, I would be long of this particular contract via the CFD markets if possible, or perhaps using binary options.

The reason that I suggest avoiding the futures contract is that the volatility that we see in the markets presently will make this a dangerous futures contract to be involved in, and quite frankly the lack of granularity will not suit most retail traders. With that, it’s a most impossible to recommend the futures contract unless of course you have the correct sized trading account.

Nonetheless, I am bullish in this market over the longer term but I also recognize that we are in the middle of the summer, with the norm being fairly quiet choppiness. I think of this more or less as a slightly bullish market and as you can see we have gradually been going higher, but have seen violent pullbacks and shots higher.

Watch the headlines and US dollar.

I believe the launching the headlines coming out of the Middle East will be vital, as well as the headlines coming out of Russia itself. Remember, Russia is a major exporter of oil, but at the end of the day is a different grade. Nonetheless, it can bring in more demand for other grades as refineries switch. Regardless, my suggestion is to simply avoid tying up more margin than necessary, hence the idea of the contract for different markets, or in the Americas the binaries such as in the NADEX. Ultimately, I don’t really have an argument for selling this contract until we get below the $99 level, which in my opinion would show a severe breach of support.