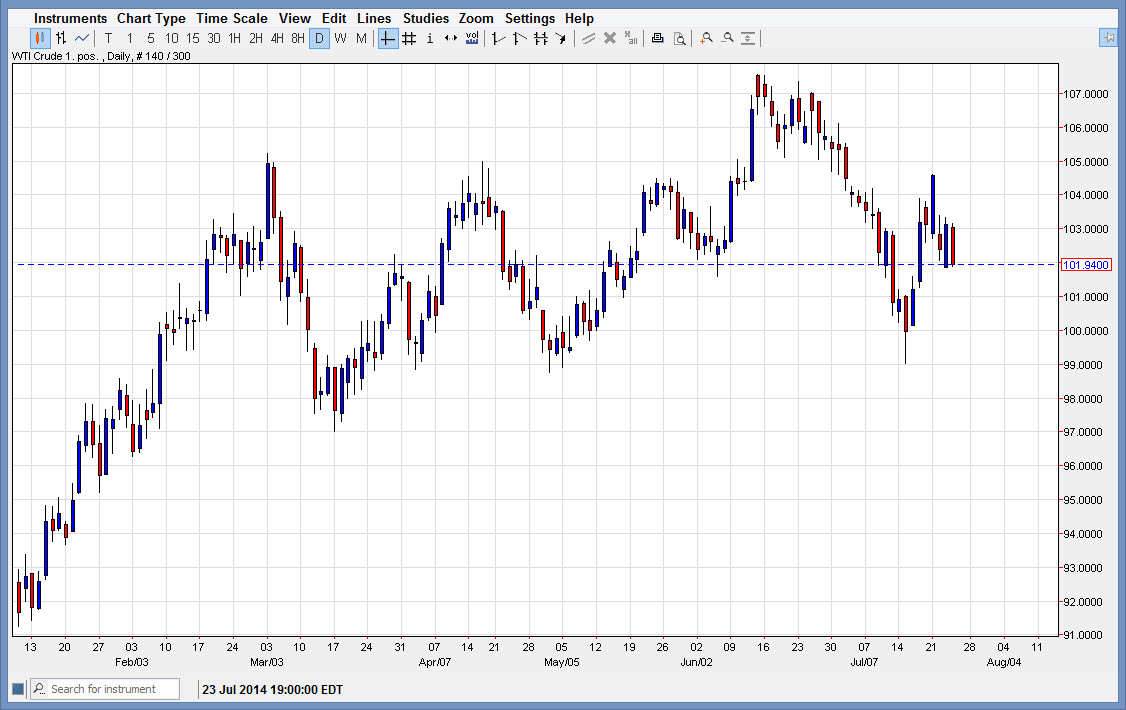

The WTI Crude Oil markets fell during the course of the day on Thursday, as we continue to consolidate right around the $102 level. That being the case, I feel that this market is simply going to go sideways today, and as a result it’s probably not a market that’s worth been bothered with. It’s not say that there will be trading opportunities, but it will be the altar short-term type, which of course is a little bit more difficult to deal with at times. With that being the case, the market will more than likely be one that you will want to look at from the longer-term charts, as it hopefully will make its intentions clear.

That being the case, I see that there is a significant amount of support all the way down to the $99 level, which in my opinion is where we would see a trend change if we managed to break down below it. With that, I would be very hesitant to sell this market at this point, and essentially still feel that it’s one that I can only buy, but quite frankly I feel that it’s going to be dangers regardless. I’m not really excited about trading this market, not without a longer-term signal.

Watching this market for my opportunity.

A lot of analysts out there think of this market is going to continue to go lower, but I see that it is more of a choppy market with a slightly upward bias. Slight being the key word, simply because there isn’t much in the way of an impulsive trend of the moment. However, I feel that ultimately this market will go higher, but since we are heading into the summer months, it’s very likely that we could be a little bit slow getting anywhere in particular. With that, I feel that you are going to have to be patient, and therefore I am more interested in trading the longer-term chart. However, those of you that are little bit more nimble may find short-term trading opportunities over and over again area