By: Ben Myers

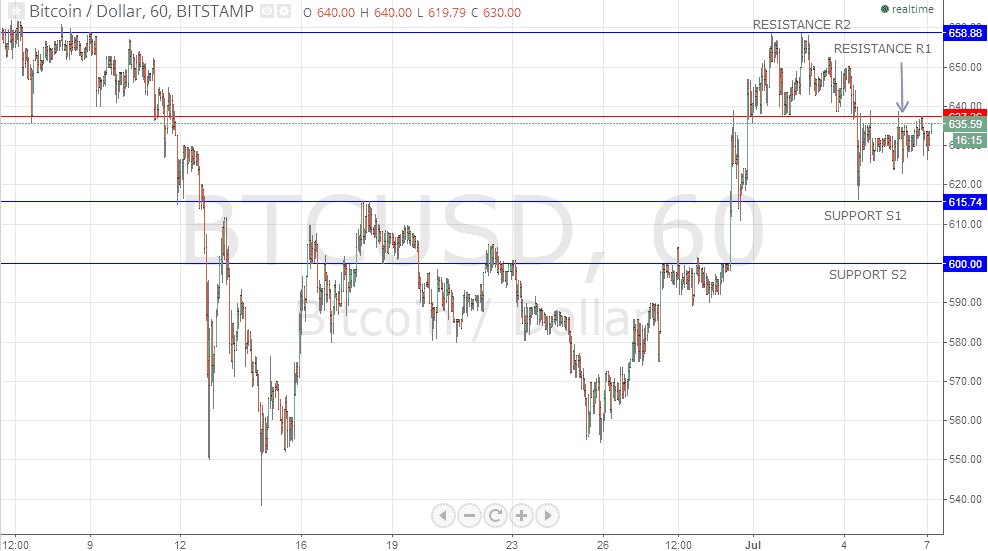

The price of Bitcoin after closing below the support level of 638 has been unable to make any major upmove. As it can be observed from the hourly BTC/USD chart above, all attempts to break above the resistance R1 have been in vain and Bitcoin can be seen consolidating in a narrow range of approximately 15 points. The support levels for the pair are marked as S1 near 615 and S2 near 600. With no near term triggers in sight, BTC/USD is expected to remain range-bound between 615 and 638. Bitcoin is currently valued at $635.59.

Traders may use every rise towards 638 as an opportunity to sell this pair by placing a stop-loss near 640 for a target of 628. Though the profit-to-loss ratio for this trade is very attractive at 5:1, traders must adhere to a strict discipline as the stop-loss is in close range and a breach above it may push the pair towards resistance R2 near 660. Fresh long positions can also be considered above 640 for a target of 655 with a stop-loss at 635. Buying can also be initiated at lower levels near 620 for a target of 635 by keeping a stop-loss at S1 as indicated on the chart.

A Hong Kong-based Bitcoin exchange Coinport has initiated “extreme” transparency measures such as automatic proof-of-reserves tests and access to all the exchange’s trading and fund storage data, in a bid to make cryptocurrency exchanges more trustworthy. Coinport’s founder Daniel Wang has admitted that existing exchanges may abuse the faith of the customers, which have already become victims of the failure of Mt. Gox. His measures are expected to prompt other exchanges to incorporate such measures so that customer confidence in the digital currencies, which had taken a sharp dip post the Mt. Gox debacle, can be restored.