By: Ben Myers

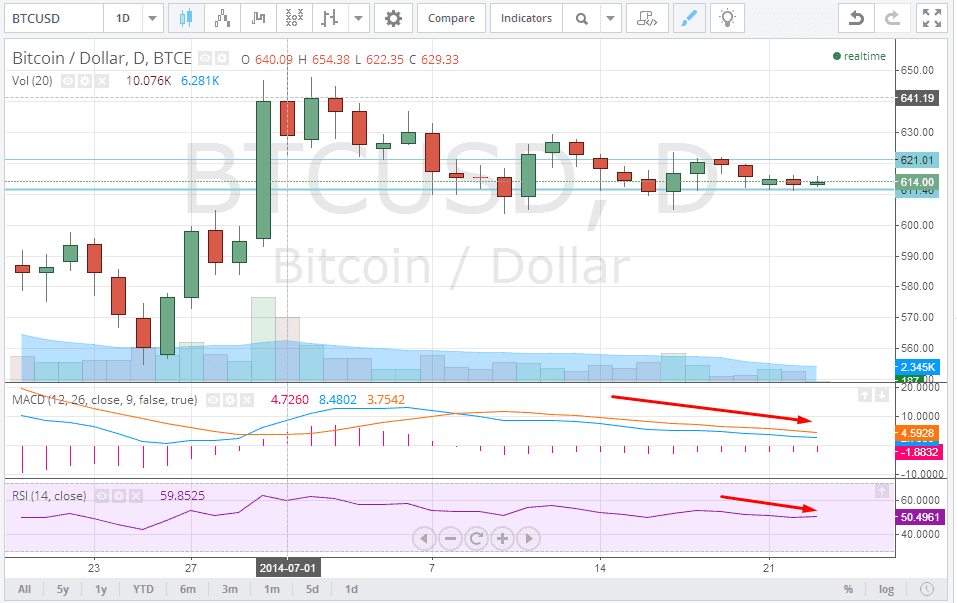

BTC/USD continues once again to trade in a narrow range with the resistance level set at $621.17 and strong support being found at $611. In yesterday’s trading sessions, the digital currency continued in a very narrow range forming a candlestick pattern, which shows that both the bulls and bears are remaining on the sidelines and looking for a trigger to spark some significant future price movement. The momentum indicators for the BTC/USD have provided a fresh sell signal and till the time the digital currency doesn’t break above the resistance levels or breaks down below the support zone, we expect to continue this sideways correction.

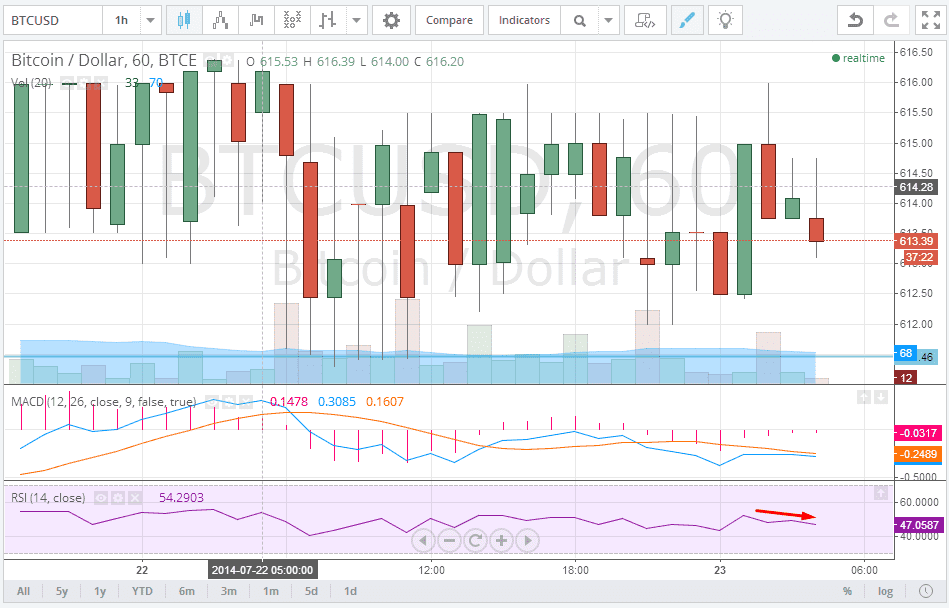

On the hourly chart BTC/USD has resistance at $616.50 on upside while strong support at $612.50 on the downside. The momentum indicators for BTC/USD on hourly charts have been trading with negative bias with no signs of revival at the current moment. Traders are therefore advised to wait for decisive breakout.

On the fundamental front, in India, Bitcoin supporters have scaled up their efforts to re-launch the cryptocurrency, after it was given a red flag by the Reserve Bank of India. Bitcoin start-ups like Coinsecure and Unocoin, are working towards placing Bitcoin as an acknowledgeable currency and are confident that eventually, things will turn in favour of the cryptocurrency.

Currently the Indian government is unclear about how laws would apply to Bitcoin. NA Vijayshankar, a cyber-law expert said that the government could not really interfere with Bitcoin transactions right now, but according to some, they could tax it in some way.

In Japan former Goldman Sachs employee Yuzo Kano is trying to re-build trust in the virtual currency, post failure of Mt. Gox. Kano launched bitFlyer in April that allows anyone with a Japanese bank account to sell and buy the coins. Unlike Mt. Gox which largely catered to foreign nationals in Japan, bitFlyer is trying to connect with local residents. However, Kano has stressed on the need of comprehensive regulations because he thinks that any kind of disaster or fraud will completely put an end to the future of Bitcoins altogether. This comes on the back of Bitcoin falling from nearly $1200 to $340 following the Mt Gox scandal.