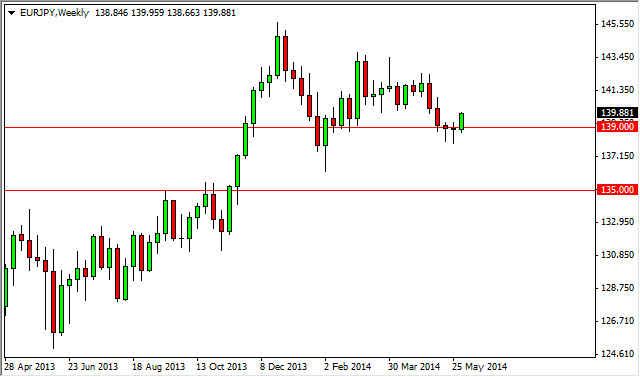

EUR/JPY

The EUR/JPY pair rose during the week, breaking above the two previous hammers that had formed at the 139 level. This market looks as if it is ready to go higher now, and I believe that we are going to head to the top of the recent consolidation – at the 143.50 level. Because of this, I am long of this pair at the moment. (I am also long TRY/JPY as well.) I believe that the Yen will continue to depreciate, and the Bank of Japan will get its wish eventually. The Euro was most certainly sold off too much, as the action of the last two days of this past week have shown.

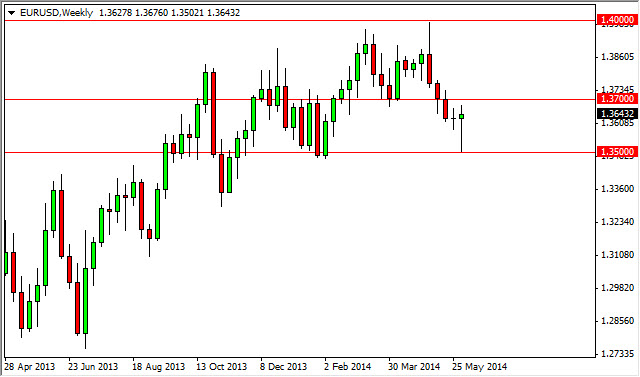

EUR/USD

The EUR/USD pair initially fell hard after the Thursday announcement from the ECB that the bank was going into “negative rates” to force banks to lend to each other. However, this was leaked during a press conference previously, so it wasn’t long before the larger players in the market started buying “value” at the 1.35 handle. Because of this, we have a hammer, and it looks as if the market is going to continue to go higher going forward. The 1.37 level is in fact a bit of a speed bump. With this, we feel the market will be a bit jagged – but positive.

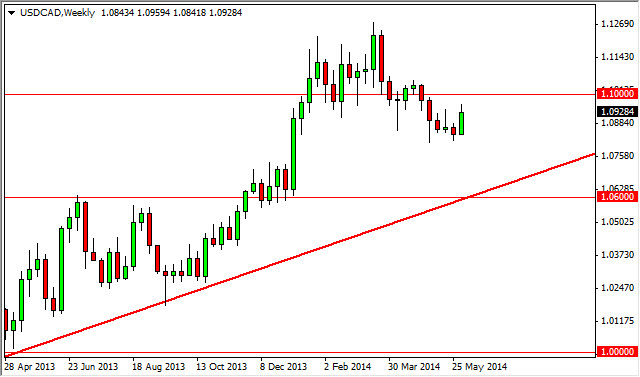

USD/CAD

The USD/CAD pair rose during the course of the week, using the 1.08 level as a springboard. Because of this, the week ended towards the top of the range, and this of course is positive as well. However, I see the 1.10 level as being a bit of a barrier, so I will like this pair to the long time if I get a daily close above that level. The market could pull back, but as you can see there is an uptrend line that could come into play if we do in fact fall.

Watch the oil markets, they always seem to move the Canadian dollar.

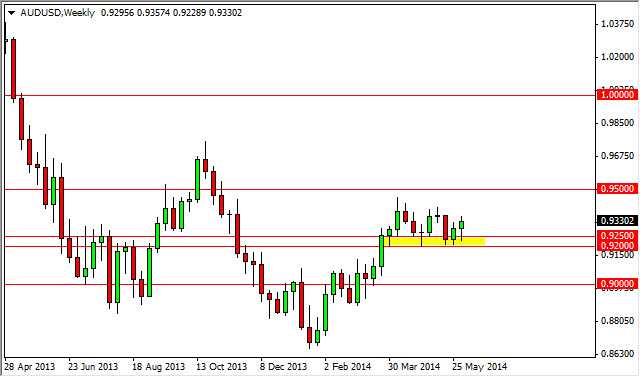

AUD/USD

The AUD/USD pair fell initially during the week, but the 0.92 level offered a bit of support, and the pair formed a hammer by the time we closed on Friday. The market looks as if the area is going to be supportive, and because of this I feel that the market will target the 0.95 handle. The 0.95 level should offer resistance as well, but will more than likely be a stopping point along the way to the parity level.