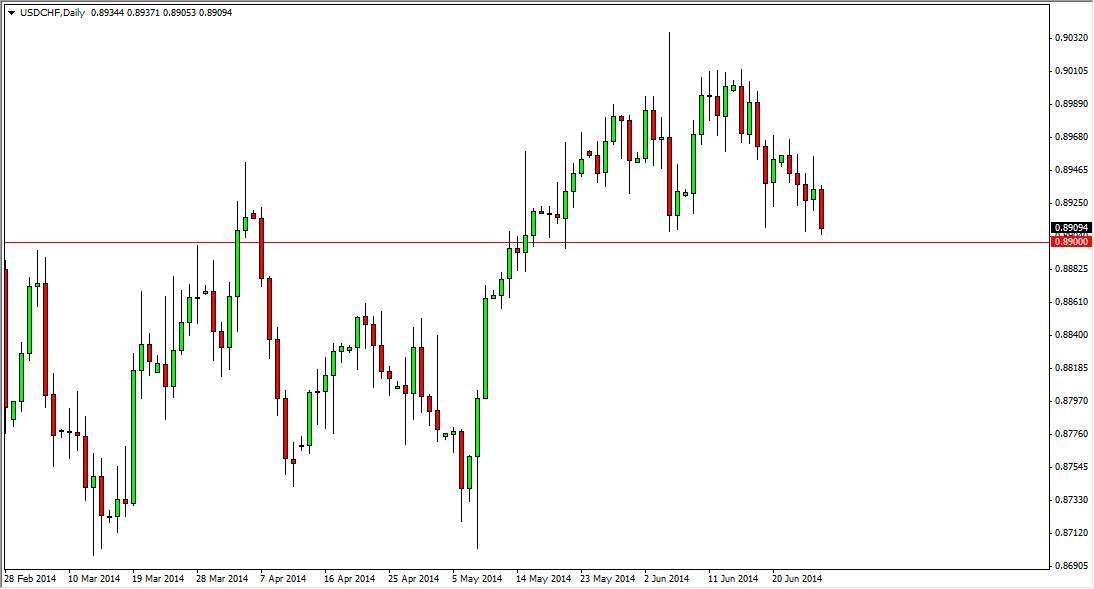

The USD/CHF pair fell during the session on Friday, but sits just above the 0.89 support level. This level has been rather reliable so far, and as a result it’s difficult to sell this market until we clear that level significantly. However, we don’t necessarily have a supportive candle though, so it’s almost impossible to start buying quite yet. After all, the market broke down significantly during the session on Friday and even closed at the very lows. With that, it suggests that there will be continued selling pressure.

Remember, this pair is the polar opposite of the EUR/USD pair, which looks like it might be ready to go little bit higher. In fact, I am actually a little bit more comfortable selling this pair than buying the EUR/USD, so that might be the play. Ultimately, this market on a break down could go as low as the 0.87 level, but much like the EUR/USD pair, expect this to be a slow-moving market.

Remember, both of these are considered safety currencies.

One of the reasons that a lot of newer traders ignore this pair is that both currencies tend to be safety currencies. It doesn’t really matter though, because while most people are worried about the EUR/USD pair, trades can be made over here that are just as profitable. Granted, the spreads probably going to be a little bit higher than the spread in the EUR/USD pair with your broker, but the spread is still fairly tight, typically about three pips.

I believe that ultimately the 0.89 level will be the “decision-maker” going forward, and as a result I think that the markets will be making a fairly obvious move soon. I am watching this market, as I don’t necessarily have a trade signal yet, but recognize that we are at a significant inflection point. Most of trading is simply waiting to get to a decent inflection point, which is where we are now. By being patient, you can let the market tell you what it wants to do, and then simply follow. That’s the easiest way to make money that I know.