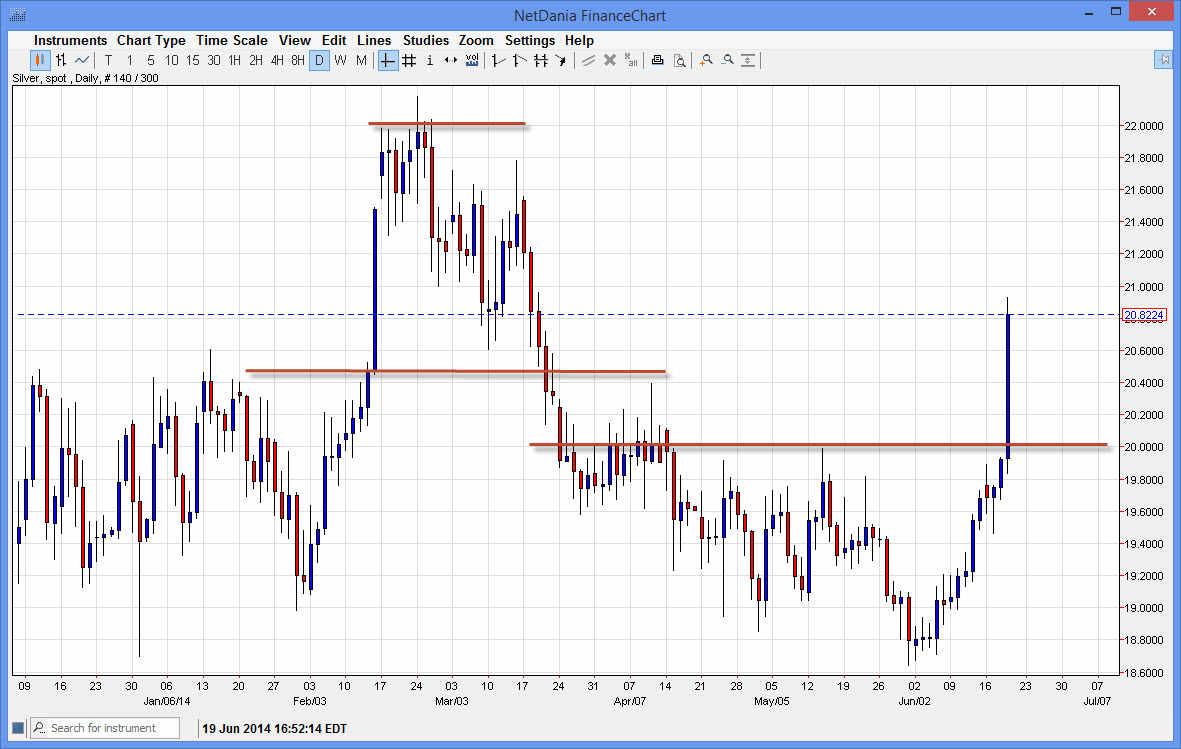

The silver markets had an absolutely explosive session on Thursday, slicing through the $20 level like it wasn’t even there. That area has been rather resistive, but recently I have been pointing out that it appears the market is trying to build up enough momentum to breakout. I have to admit though, the breakout has been rather strong and explosive, much more than anticipated. On top of that, I believed that the $20.50 level would be resistive as well. That level was cracked without much fanfare, as the market gained almost 4%.

With this, it should be obvious that the momentum is certainly with the buyers. Pullbacks on short-term charts should continue to see buyers step in over and over, as a lot of the sellers will have now found themselves in bad positions. They will cover as soon as they get a chance to save a little bit of money, not to mention the fact that so many traders out there would have missed this move. They will look at this candle as a signal to start buying, and I believe that pullbacks will attract them.

Metals markets on fire.

All of the metals markets I follow are on fire during the session on Thursday. Silver looks as if it’s ready to continue to go higher, and I believe that the first thing that we will run into as far as resistance is just above at the $21.00 level. However, I believe that pullbacks will find enough momentum to push through that level and head towards the $22.00 level. That area is actually my longer-term goal, and that’s $22 level is vital in determining where this market goes going forward now. If we get above there, this market should head to the $25 level next, which of course would be a very significant move in the highly leveraged silver futures.

Options markets are doable as well, as are CFD markets. This allows the smaller trader to get involved in the silver markets, which of course asks for large amounts of margin, and can be very dangerous to trade if you have a smaller account.