The XAU/USD pair closed higher than opening as the American dollar lost some strength across the board after the data released by the Commerce Department showed that demand for durable goods slumped in May and the U.S. economy contracted more than previously expected in the first quarter. The pair traded as high as $1324.86 an ounce before retreating back to 1316 level.

I think yesterday's price movement shows that investors don’t care much about the weakness in the first quarter because the economic data from the U.S. over the last weeks bolstered the view that softness was caused by unusually severe winter weather, not inherent economic weakness. As people say “it is not the news but the market reaction to news that matters”.

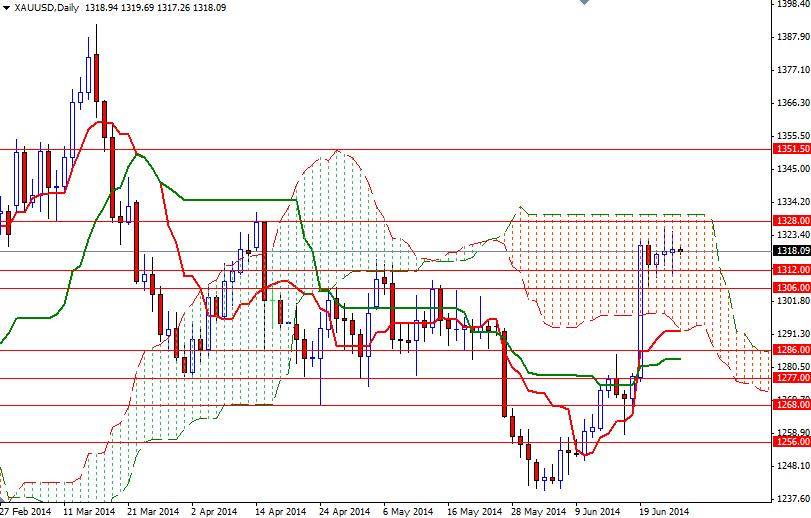

Speaking strictly based on the charts, the daily chart suggests that the market is neutral while trading inside the Ichimoku clouds and the candlesticks are indicating a real lack of momentum. I think the XAU/USD pair will have a hard time gaining traction in either direction at this point. The key levels to pay attention will be the 1323/31 and 1306 levels. The XAU/USD pair has to push its way through the 1323/31 resistance zone in order to extend its gains. If that is the case, I will look for 1334 and 1340. To the down side, there is an interim support between 1312 and 1310. Below that, an important challenge will be waiting the bears at 1306. Breaching this support could drag prices towards the 1300 - 1297 zone.